(Finance) – The Wall Street stock exchange continues to be mixed with investors who on the one hand have welcomed the decision of the Chinese authorities to loosen the anti-Covid restrictions and to eliminate the quarantine for Chinese citizens and foreigners coming from abroad, on starting in January.

In the background, however, concerns remain that the new year could be one of recession in the United States, after recent data such as better-than-expected GDP and lower-than-expected unemployment benefits confirmed that the US economy can support the monetary tightening by the Federal Reserve.

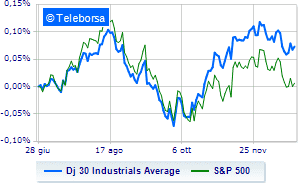

Among US indices, the Dow Jones than by 0.35% to 33,320 points, while, on the contrary, colorless theS&P-500, which continues the session at 3,838 points, on the same levels as before. In red the NASDAQ 100 (-1.11%); along the same lines, in fractional decline theS&P 100 (-0.35%).

All sectors slide on the American S&P 500 list.

At the top of the rankings American giants components of the Dow Jones, Verizon Communication (+2.39%), Caterpillar (+1.50%), Nike (+1.43%) and Salesforce, (+1.17%).

The worst performances, however, are recorded on Applewhich gets -1.26%.

Small loss for Walt Disneywhich trades with -0.84%.

He hesitates Goldman Sachswhich drops 0.77%.

Basically weak Walgreens Boots Alliance,which recorded a decrease of 0.56%.

To the top between Wall Street tech giantsthey position themselves Baidu (+4.24%), JD.com (+3.77%), NetEase (+2.15%) and Lululemon Athletica (+2.14%).

The worst performances, however, are recorded on Tesla Motorswhich gets -8.04%.

It collapses Modernwith a drop of 7.95%.

Hands-on sales Lucid Group,which suffers a decrease of 6.87%.

Bad performance for Enphase Energy,which records a drop of 5.76%.

Among macroeconomic appointments which will have the greatest influence on the performance of the US markets:

Tuesday 12/27/2022

2.30pm USA: Inventories wholesale, monthly (exp. 0.4%; prev. 0.6%)

Wednesday 12/28/2022

4:00 pm USA: Home sales in progress, monthly (exp. -0.8%; previous -4.6%)

Thursday 29/12/2022

2.30pm USA: Initial Jobless Claims, Weekly (Expected 225K; Previously 216K)

5pm USA: Oil inventories, weekly (exp -1.66 Mln barrels; prev -5.89 Mln barrels)

Friday 12/30/2022

3.45pm USA: PMI Chicago (exp. 40 points; previous 37.2 points).