The value of tomorrow is realized in partnership with Zonebourse.com

Aalberts has long been considered a somewhat catch-all multidisciplinary group, more renowned for its thirst for acquisitions than for the clarity of its business model. But the strategy has evolved in recent years, to give shape to a more coherent industrial group. The Dutch remains a conglomerate, but a conglomerate concentrated on four main businesses, with a marked exposure to end markets in relation to infrastructure – in particular buildings –, industry and transport.

Activities can be classified into two main categories. Building technology (62% of 2021 revenue) includes the fluid businesses, i.e. pipes for the transport of liquids and gases (Aalberts Integrated Piping Systems) and hydronic heating and cooling systems (Aalberts Hydronic Flow Control). Plumbing, in a somewhat trivial version, but sophisticated and of excellent reputation. Industrial technologies (38% of revenues) include surface coating solutions (Aalberts Surface Technologies) and advanced mechatronics (Aalberts Advanced Mechatronics), which deserve some explanation. The surface coating branch provides processes that, for example, improve the sterilization of medical instruments or reduce the friction and scratch sensitivity of automotive paints. Mechatronics, which designs both purity systems for high-tech industries and solutions for controlling vibrations, is very well established in semiconductors.

The current perimeter is the result of a weight loss program that is both qualitative and quantitative. Ten years ago, Aalberts still had twelve jobs. The refocusing was carried out on specialties in which the group has a competitive advantage and which benefit from solid underlying trends. In particular, the energy efficiency of buildings, a bugbear at the moment but which remains lucrative. It goes without saying that the semiconductor sector is also one of the industries that have the wind in their sails. This positioning on popular themes, that is to say in high demand, has enabled Aalberts to pass on the increase in its costs to its customers without too much difficulty, in particular the increase in its own energy bill.

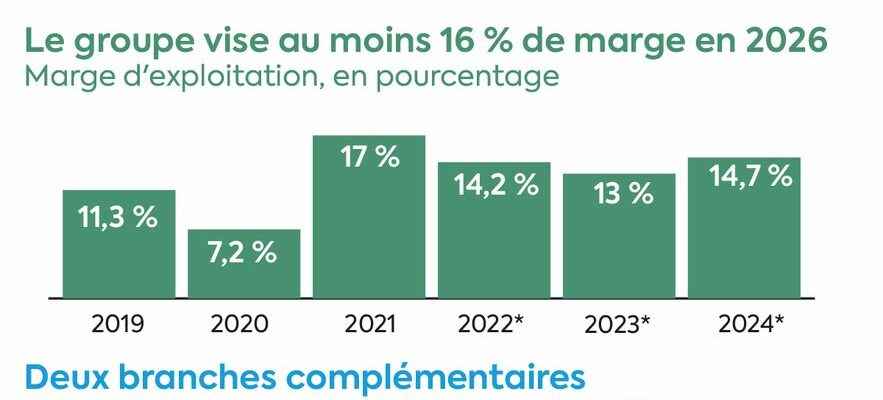

On the financial side, we remain on the profile of a niche industrial conglomerate. In other words, the overall business is showing a gentle slope but the margins are quite generous. Turnover has been growing steadily but moderately since 2012, except in 2020, an exception linked to Covid which confirms the rule. It was around 3 billion euros last year, predominantly European (59%) and North American (24.5%). The operating margin flirts with 11%, except in 2020 again. As for the balance sheet, it does not present any particular weakness: the level of indebtedness is reasonable and the company posts a good generation of liquidities, which enables it to pay a correct dividend.

infographics

© / Dario Ingiusto / L’Express

The new Aalberts, more attractive than the old one

The outlook could be described as reasonably ambitious. Aalberts aims to grow by 4-6% per year over the period 2022-2026, achieving an operating margin of between 16-18% over time. The company’s valuation multiples are currently lower than its historical average, despite the effort to rationalize the activity. If the medium-term plan unveiled by management is respected, they should mechanically improve further.

In short, the new Aalberts is more attractive than the old one. Its business model is refocused on building efficiency, one of the key themes of the decade, and on industrial technologies, which expose it to dynamic sectors.

infographics

© / Dario Ingiusto / L’Express