(Finance) – A day of gains for the New York Stock Exchange, with investors awaiting the Federal Reserve’s decisions on Wednesday: the American Central Bank led by Jerome Powell should slow down the pace of interest rate hikes. However, higher-than-expected PPI inflation data released last Friday renewed recession fears.

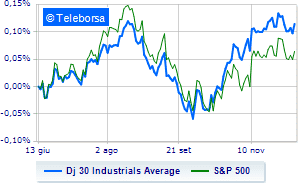

Among US indices, the Dow Jones shows a capital gain of 0.80%; along the same lines, theS&P-500 proceeds in small steps, advancing to 3,953 points. On equality the NASDAQ 100 (+0.06%); fractional earnings forS&P 100 (+0.44%).

All sectors slide on the American S&P 500 list.

Between protagonists of the Dow Jones, boeing (+2.87%), American Express (+2.25%), Visa (+2.07%) and Microsoft (+1.95%).

The strongest declines, however, occur on Amgenwhich continues the session with -1.44%.

Thoughtful 3Ma fractional decline of 0.56%.

Between best performers of the Nasdaq 100, Atlassian (+8.16%), document sign, (+7.97%), Okta, (+5.02%) and Datadog (+4.97%).

The worst performances, however, are recorded on Modernwhich gets -7.47%.

At a loss Tesla Motorswhich drops by 4.11%.

Heavy Baiduwhich marks a drop of as much as -3.81 percentage points.

Sales on Lucid Group,which records a drop of 3.74%.

Between macroeconomic quantities most important of the US markets:

Tuesday 12/13/2022

2.30pm USA: Consumption prices, annual (expected 7.3%; previous 7.7%)

2.30pm USA: Consumption prices, monthly (expected 0.3%; previous 0.4%)

Wednesday 12/14/2022

2.30pm USA: Export Prices, Monthly (exp. -0.6%; previous -0.3%)

2.30pm USA: Import prices, monthly (exp. -0.5%; previous -0.2%)

4.30pm USA: Oil inventories, weekly (exp -680K barrels; prev -5.19 Mln barrels).