Belgium and Luxembourg in the lead. This is not the ranking of a continental sports competition, but of the European Union (EU) countries that have most frozen the assets of Russian oligarchs and entities targeted by sanctions in response to the war in Ukraine. According to figures collected by the Commission from the Member States, 18.9 billion euros in assets have, at this stage, been frozen.

Eight countries have each blocked more than one billion euros in assets: Belgium (3.5 billion) in the lead, followed by Luxembourg (2.5), Italy (2.3), Germany (2.2), Ireland (1.8), Austria (1.8), France (1.3) and Spain (1), according to a summary table of amounts declared as of November 25, consulted on Friday December 9 by AFP. On November 21, L’Express had revealed this figure of only 1.3 billion euros of goods (physical and financial) frozen in France, according to exclusive figures collected from the Ministry of the Economy.

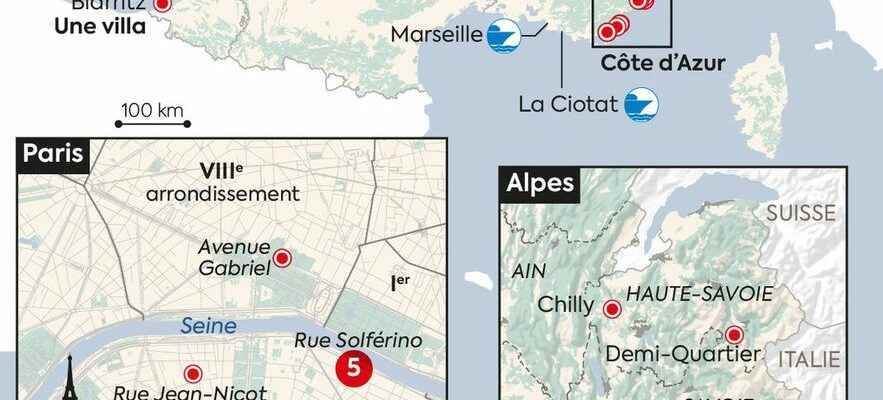

Infographics

© / Dario Ingiusto / L’Express

Belgium and Luxembourg have also frozen assets of the National Settlement Depository (NSD), the central securities depository of the Russian Federation, sanctioned by the EU: 46.9 billion for Belgium, 3 billion for Luxembourg.

Malta, a country that has introduced a controversial regime of “golden passports” granted to wealthy investors, is at the bottom of the pack, with 146,558 euros in blocked assets; Greece is second to last with 212,201 euros. A total of 1,241 individuals and 118 entities are subject to an asset freeze and a ban on entering EU territory because of their role in the conflict in Ukraine.

7.5 billion Russian assets frozen in Switzerland

Outside the EU this time, the amount of Russian assets frozen in Switzerland amounted to 7.5 billion Swiss francs (7.6 billion euros) as of November 25, the State Secretariat for the economy (Seco). This is almost a billion Swiss francs more than the amount made public by Seco last July.

Switzerland is a popular destination for Silver Russians or businesses from the country, being a well-known hub for commodity trading. In addition to the 7.5 billion, there are also 15 real estate properties in six Swiss cantons, said the Seco, without giving further details on the nature of these properties.

Erwin Bollinger, head of bilateral economic relations at the State Secretariat, nevertheless explained that the amount “does not reflect the effectiveness of the sanctions”. Indeed, the Swiss authorities are sometimes required to block funds as a preventive measure, the time to make the necessary checks and assess whether they fall under the blows of the numerous sanctions imposed on Russia since its invasion of Ukraine on February 24. .

Information provided “unequal from one Member State to another”

European Commissioners Didier Reynders (Justice) and Mairead McGuinness (Financial Services) wrote on Thursday 8 December to the Ministers of Justice and Finance of EU countries to remind them that the freezing of the assets of sanctioned persons and entities was mandatory, as well as the communication of data in this regard.

“However, the information provided and the frequency of updates remain uneven from one Member State to another. This is detrimental to our collective efforts”, they lament. “Therefore, we encourage you to freeze the assets quickly and effectively and to ask your authorities to update the information provided to the European Commission more regularly.”

At their summit on October 20 and 21, the leaders of the Twenty-Seven had asked the European Commission to study the possible options with a view to using the frozen assets for the reconstruction of Ukraine. The European executive presented leads in this direction on 30 November. Russia’s invasion of Ukraine has significantly lengthened the list of people subject to asset freezes by the EU or other international bodies, making the painstaking work even more tedious for financial players.