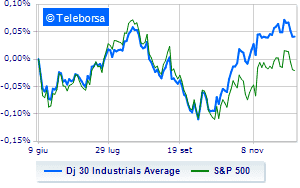

(Finance) – The US price list shows a timid gain, with the Dow Jones which is achieving +0.41%, while, on the contrary, theS&P-500 (New York), which stands at 3,942 points, close to the previous levels.

On the levels of the eve the NASDAQ 100 (0%); as well as, consolidates the levels of the eve theS&P 100 (+0.1%).

All sectors slide on the American S&P 500 list.

Among the best Blue Chips of the Dow Jones, 3M (+1.42%), Merck (+1.06%), Amgen (+0.87%) and Home Depot (+0.85%).

The strongest sales, on the other hand, show up Salesforce,which continues trading at -2.09%.

Undertone Apple showing a filing of 1.38%.

Disappointing boeingwhich lies just below the levels of the eve.

Slack intelwhich shows a small decrease of 0.94%.

On the podium of the Nasdaq stocks, Modern (+3.15%), PayPal (+3.03%), Regeneron Pharmaceuticals (+2.25%) and work day (+2.08%).

The strongest declines, however, occur on Booking Holdingswhich continues the session with -4.24%.

Under pressure Tesla Motorswhich shows a drop of 3.21%.

Slide JD.comwith a clear disadvantage of 3.15%.

In red Baiduwhich shows a marked decrease of 2.34%.

Among the data relevant macroeconomics on US markets:

Thursday 08/12/2022

2.30pm USA: Initial Jobless Claims, Weekly (Expected 230K; Previously 226K)

Friday 09/12/2022

2.30pm USA: Production prices, yearly (expected 7.2%; previous 8%)

2.30pm USA: Production prices, monthly (expected 0.2%; previous 0.2%)

4:00 pm USA: Inventories wholesale, monthly (exp. 0.8%; prev. 0.6%)

4:00 pm USA: University of Michigan Consumer Confidence (expected 56.9 points; previous 56.8 points).