(Finance) – A bearish start for the Wall Street stock exchange, as expected, anticipated by the red performance of US derivatives. The data on the American labor market contributes to weighing on investor sentiment, which appeared solid in November, despite the interest rate hikes decided by the Federal Reserve. Last month, 263,000 jobs were created, more than the 200,000 expected by analysts, while the unemployment rate remained unchanged at 3.7%, as forecast.

Now the ball passes to US central bank which could continue with the very aggressive strategy adopted so far on the cost of money, even if the president of the institute, Jerome Powellin recent days, has opened to a slowdown in the tightening, already from the monetary policy meeting scheduled for this month.

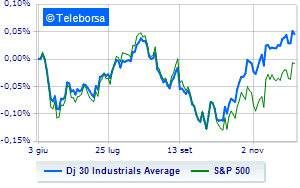

Among US indices, the Dow Jones he is leaving 0.72% on the floor; along the same lines, theS&P-500 it lost 0.93%, continuing the session at 4,039 points. In red the NASDAQ 100 (-1.29%); as well, down theS&P 100 (-0.96%).

All sectors slide on the American S&P 500 list.

Between protagonists of the Dow Jones, Nike (+1.29%), Home Depot (+0.95%), Walt Disney (+0.74%) and Wal-Mart (+0.62%).

The strongest sales, on the other hand, show up Salesforce,which continues trading at -8.27%.

Under pressure United Healthwhich shows a drop of 1.85%.

Slide boeingwith a clear disadvantage of 1.73%.

In red Verizon Communicationwhich shows a marked decrease of 1.61%.

Between best performers of the Nasdaq 100, Okta, (+26.46%), Splunk (+17.78%), zscaler, (+8.28%) and Atlassian (+6.47%).

The worst performances, however, are recorded on Costco Wholesalewhich gets -6.56%.

The negative performance of Micron Technologywhich drops by 3.76%.

Black session for NetEasewhich leaves a loss of 4.04% on the table.

Lucid Group, drops by 2.82%.

Among the data relevant macroeconomics on US markets:

Friday 02/12/2022

2.30pm USA: Unemployment rate (expected 3.7%; previous 3.7%)

2.30pm USA: Variation in employment (expected 200K units; previous 284K units)

Monday 05/12/2022

3.45pm USA: PMI services (previous 46.1 points)

3.45pm USA: Composite PMI (previously 46.3 points)

4:00 pm USA: Industrial orders, monthly (0.8% expected; previous 0.3%).