(Tiper Stock Exchange) – The main Stock Exchanges of the Old Continent are all positivewhich have not aligned themselves with the uncertainty of the US and Asian markets following the hawkish comments of some FED officials which suggest that there will still be aggressive interventions on interest rates. Christine Lagardepresident of the European Central Bank, said that Frankfurt plans to raise rates further and that the ECB will also have to “normalize the other instruments and thus strengthen the momentum of interest rate policy“.

Frankfurt’s number one also underlined that, in an economic environment characterized by “multiple shocks and profound uncertainty”, the Eurozone it must not water down regulation of the banking sector risking ending up with weaker banks and, ultimately, less credit to the economy.

Still remaining in Frankfurt, it was disclosed that banks in the euro zone have repaid in advance 296 billion euros of TLTRO III funds granted by the ECB. This is lower than market expectations.

On macroeconomic frontdata on retail sales in the United Kingdom improved in October 2022. Instead, Istat communicated that the construction production index increased by 0.2% in September 2022 compared to the previous month, recording the second cyclical increase consecutive.

positive A2Awho announced last night that on 23 November he will present theupdate of the business plan 2021-2030 to the financial community, the press and trade union associations.

Little move Sesawhich announced the 14th acquisition since the beginning of the year, thus continuing to fuel its growth path through bolt-on industrial M&A in sectors of strategic importance for its development.

salt Webuild And goes down Salcefwhich in the consortium have been awarded a new contract in Romania of a total value of 441 million euros to upgrade the Rhine-Danube corridor of the trans-European transport network TEN-T.

It collapses Treviin volatility auction with a 30% reduction, after yesterday evening the board of directors resolved two capital increases for a total of 51 million euros.

L’Euro / US Dollar it is substantially stable and stops at 1.038. L’Gold the session continued at the previous levels, reporting a variation of +0.03%. Deep red for oil (Light Sweet Crude Oil), which continues trading at 80.8 dollars per barrel, down sharply by 1.03%.

He goes down it spreadscoming in at +190 basis points, down 4 basis points, while the 10-year BTP reports a yield of 3.95%.

Among the indices of Euroland Frankfurt it advances by 1.23%, moving into positive territory Londonshowing an increase of 0.79%, and money up Pariswhich recorded an increase of 1.03%.

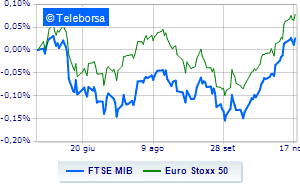

Earnings day for Milan Stock Exchangewith the FTSEMIB, which shows a capital gain of 1.06%; along the same lines, the FTSE Italia All-Share the day continues with an increase of 1.02%. Up the FTSE Italia Mid Cap (+0.72%); on the same trend, moderately rising FTSE Italy Star (+0.64%).

Between best performers of Milan, in evidence CNH Industrial (+3.60%), Saipem (+2.42%), Pirelli (+2.06%) and Tenaris (+1.96%).

The worst performancesInstead, they register on Leonardo, which gets -0.78%. It moves below parity Monclershowing a decrease of 0.52%.

At the top among Italian stocks a mid-cap, Webuild (+3.52%), El.En (+3.02%), Luve (+2.60%) and Bff Bank (+2.23%).

The stronger saleshowever, manifest themselves on GV extension, which continues trading at -3.93%. Sales on Salcef Group, which records a drop of 1.93%. Moderate contraction for CIR, which suffers a drop of 1.16%. Undertone Alerion Clean Power showing a filing of 0.97%.