(Finance) – The main European stock exchanges are confirmed as weak, at the halfway point, despite the positive closure of Wall Street which discounts the easing of inflation. Investors are watching the evolution of geopolitical risks in the conflict in Ukraineafter rockets crashed in Poland which killed two people.

L’Euro / US Dollar continues the session higher and advances to 1.042 level. The ECB has once again warned of increased risks to financial stability due to rising energy prices, high inflation and low economic growth. No significant change for thegold, which trades on the previous day’s values at 1,782.6 dollars an ounce. Weak session for Light Sweet Crude Oil, trading down 0.58%.

Slightly up spreadswhich stands at +191 basis points, with a timid increase of 3 basis points, with the yield on the 10-year BTP equal to 3.99%. ECB interest rates “are still below the level consistent with achieving our medium-term inflation target. The need to continue the restrictive action is therefore evident, even if the reasons for implementing a less aggressive approach are gaining ground”, said today the governor of the Bank of Italy, Ignazio Visco.

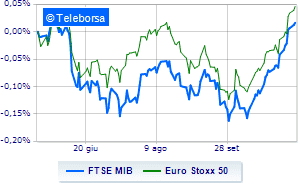

Among the indices of Euroland cautious progress for Frankfurtwhich shows a performance of +0.17%, with little movement London, which shows -0.08%, UK inflation soared to a 41-year high; small loss for Paris, which trades with -0.53%. The Milanese price list continues the session just below parity, with the FTSEMIB which limits 0.60%: Istat has revised the inflation figure for October to 11.8% from 11.9%, which in any case remains at highest since March 1984.

At the top of the ranking of the most important titles of Milan, we find Tenaris (+0.75%) and Leonardo (+0.67%).

The worst performances, however, are recorded on amplifierwhich gets -3.49%.

Telecom Italy drops by 3.43% after the rating review by the Fitch agency.

Decided decline for Inwitwhich marks a -2.55%.

Under pressure Pirelliwith a sharp drop of 2.28%.

Among the protagonists of the FTSE MidCap, Caltagirone SpA (+1.50%), MARR (+1.45%), GV extension (+1.06%) and SOL (+0.87%).

The strongest sales, on the other hand, show up Carel Industrieswhich continues trading at -5.16%.

Thump of Drywhich shows a drop of 4.50%.

Letter about Mortgages onlinewhich records a significant drop of 4.33%.

Goes down Juventuswith a drop of 4.03%.

Between macroeconomic variables heavier:

Wednesday 11/16/2022

01:50 Japan: Core Machinery Orders, Monthly (Exp. 0.7%; Previous -5.8%)

06:30 Japan: Services index, monthly (exp. 0.6%; previous 0.7%)

08:00 United Kingdom: Consumption prices, yearly (expected 10.7%; previous 10.1%)

08:00 United Kingdom: Production prices, monthly (expected 0.5%; previous 0.3%)

08:00 United Kingdom: Consumption prices, monthly (expected 1.7%; previous 0.5%).