(Finance) – Mixed first session of the week for the Wall Street stock exchange with investors always attentive to central banks, after the hawiksh comments on the subject of inflation by Governor Waller. The member of the Federal Reserve Board of Governors warned of the latest data on US inflation below expectations, underlining that more data will be needed for the Fed to ease monetary tightening.

Investors are also looking at the outcome of midterm elections in USA. The Democrats narrowly won the Senate which therefore remains under their control. Instead, the Republicans gained control in the House.

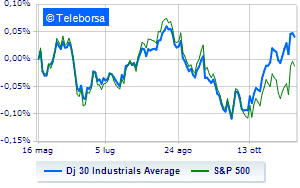

Among US indices, the Dow Jones climbed 0.34%, while the S&P-500 climbed timidly by 0.05%. The Nasdaq 100 is also down (-0.12%); the S&P 100 was down moderately (-0.39%).

Among the best Blue Chips of the Dow Jones, Merck (+3.68%), Johnson & Johnson (+2.09%), IBM (+1.77%) and Travelers Company (+1.73%).

The strongest declines, however, occurred on Wal-Martwhich closed the session at -1.80%.

He suffers Microsoftwhich shows a loss of 1.69%.

Undertone Home Depot showing a filing of 1.35%.

Disappointing Dow which lies just below the levels of the eve.

To the top between Wall Street tech giantsthey position themselves Modern (+7.39%), biogen (+4.73%), JD.com (+4.72%) and Netflix (+4.64%).

The strongest sales, however, fell on Oktawhich finished trading at -4.38%.

Letter about Lucid Group,which records a significant drop of 4.25%.

Goes down Datadogwith a drop of 3.83%.

Between macroeconomic variables of greatest weight in the North American markets:

Tuesday 11/15/2022

2.30pm USA: Production prices, monthly (0.2% expected; previous 0.4%)

2.30pm USA: Production prices, annual (expected 8.4%; previous 8.5%)

Wednesday 11/16/2022

2.30pm USA: Import prices, monthly (previously -1.2%)

2.30pm USA: Retail sales, yearly (previously 8.23%)

2.30pm USA: Retail sales, monthly (expected 1%; previous 0%).