(Finance) – Positive day for the European stock exchanges and for Business Square, which also benefited from the good performance of Wall Street on the eve of the FOMC meeting. The Fed’s Monetary Policy Committee is expected to announce another 75 basis point interest rate hike tomorrow, but the front of bettors on a “pause” in the pace of adjustment of the cost of money is strengthening.

ECB President Christine Lagarde could also go back to playing the role of a “dove” and pause the path of normalization of monetary policy, but she will have until early December to decide what is right to do.

L’Euro / US dollar the session continues just below par, with a drop of 0.28%. L’Gold it is modestly up at $ 1,647.3 per ounce. Heavy oil buying rain (Light Sweet Crude Oil), showing a gain of 2.23%.

In marked decline it spreadwhich is positioned at +210 basis points, with a sharp decline of 12 basis points, with the yield of the 10-year BTP standing at 4.26%.

Among the Euroland indices moderately positive day for Frankfurtwhich rises by a fractional + 0.64%, weak Londonwhich file 0.37%, toned Pariswhich shows an increase of 0.98%.

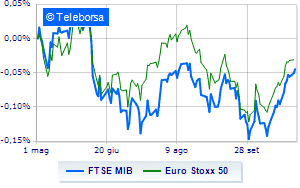

The Milanese price list shows a timid gain in closing, with the FTSE MIB which scored a + 0.63%; on the same line, slight increase for FTSE Italia All-Share, which brings to 24,728 points. On parity the FTSE Italia Mid Cap (-0.04%); below parity the FTSE Italia Starwhich shows a decline of 0.30%.

The exchange value in today’s session in Piazza Affari it amounted to 1.7 billion euros, down from 1.78 billion on the eve of the day; while the volumes traded went from 0.46 billion shares of the previous session to today’s 0.52 billion.

Top of the ranking of the most important titles of Milan, we find Telecom Italia (+ 5.15%), Tenaris (+ 2.58%), ENI (+ 1.58%) e Campari (+ 1.30%).

The strongest declines, on the other hand, occurred on Pirelliwhich closed the session at -2.46%.

Lazy Mediolanum Bankwhich shows a small decrease of 1.16%.

Moderate descent for Nexiwhich lost -0.94%.

Thoughtful DiaSorinwith a fractional decline of 0.87%.

Top of the ranking of mid-cap stocks from Milan, Caltagirone SpA (+ 5.33%), De Nora Industries (+ 2.46%), Fincantieri (+ 1.75%) e Webuild (+ 1.67%).

The strongest sales, on the other hand, fell on Sesawhich ended trading at -3.28%.

Sales focus on GVSwhich suffers a decline of 2.79%.

Sales on Datalogicwhich recorded a decline of 2.66%.

Negative sitting for Wiitwhich shows a loss of 2.47%.