(Finance) – At peak Snapwhich shows a lousy -31.6% after announcing a slowdown in revenue growth in the third quarter and did not provide guidance.

“This quarter we have taken steps to further focus our business on our three strategic priorities: growing our community and deepening their engagement with our products, re-accelerating and diversifying our revenue growth and investing in augmented reality,” he said. CEO Evan Spiegel – Growing our community to 363 million daily active users, an increase of 19% year-over-year, continues to expand our long-term opportunities as we navigate this volatile macroeconomic environment. “

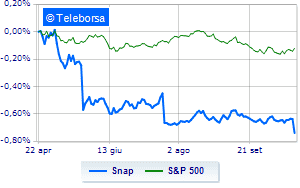

The scenario on a weekly basis of Snap detects a slackening of the curve with respect to the force expressed by theS & P-500. This withdrawal could make the title subject to sales by operators.

For the medium term, the technical implications assumed by Snap they are still read in a negative key. Some signs of improvement emerge instead for the short-term setting, read through the faster indicators that show a decrease in the speed of descent. At this point, a slowdown of the descent approaching USD 7.09 is possible. The most immediate resistance is estimated at 7.91. Expectations are for an intermediate reaction phase aimed at repositioning the technical framework on more balanced values and targets at 8.73, to be reached in a reasonably short time.