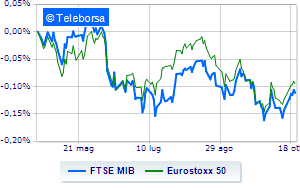

(Finance) – The indexes of Piazza Affari and of the other main European lists were all negative at the end, which is affected by the disappointing quarterly reports of many big names in the Old Continent. On the contrary, the US price list moves up well, where theS & P-500 marks an increase of 0.92%, after the Wall Street Journal rumors that some Fed bankers have begun to emphasize the need to slow the speed of rate hikes and stop next year to assess the effect of decisions on economy, so as to avoid the risk of a sudden slowdown.

On the currency market, theEuro / US dollar the session continues at the levels of the day before, reporting a variation of + 0.19%. Plus sign forgold, which shows an increase of 1.08%. Day to forget for oil (Light Sweet Crude Oil), which trades at 84.28 dollars per barrel, with a drop of 0.27%.

Consolidate the levels of the eve it spreadsettling at +234 basis points, with the yield of the ten-year BTP standing at 4.77%, while in the meantime it was assigned the task to Giorgia Meloni to form the new government.

Among the Euroland indices moderate contraction for Frankfurtwhich suffers a 0.29% decline, small step forward for London, which shows a progress of 0.37%; negative session for Paris, which shows a loss of 0.85%. Closing in fractional decline for Piazza Affari, with the FTSE MIB which leaves 0.62% on the parterre, while, on the contrary, a day of earnings for the FTSE Italia All-Sharewhich ends the day at 23,579 points.

Piazza Affari showed that the turnover in today’s session was equal to 1.53 billion euro, with an increase of 224.3 million euro, equal to 17.22% compared to the previous 1.3 billion; while the volumes traded went from 0.39 billion shares of the previous session to today’s 0.47 billion shares.

Among the best Blue Chips of Piazza Affari, shines Leonardowith a strong increase (+ 2.53%).

Excellent performance for Banca Generaliwhich registers an increase of 2.45%.

It moves into positive territory Unicreditshowing an increase of 1.40%.

Money on Finecowhich recorded an increase of 1.38%.

The strongest sales, on the other hand, fell on Campariwhich ended trading at -3.11%.

Negative sitting for Monclerwhich falls by 2.94%.

Sensible losses for Inwitdown 2.84%.

Under pressure Nexiwhich shows a decrease of 2.82%.

Between best stocks in the FTSE MidCap, Antares Vision (+ 13.20%), Seco (+ 5.43%), doValue (+ 3.09%) e SOL (+ 2.76%).

The strongest declines, on the other hand, occurred on Ferragamowhich closed the session at -3.18%.

Breathless Aceawhich falls by 3.10%.

Thud of Ascopiavewhich shows a 3.03% drop.

Letter on GVSwhich records a significant decline of 3.00%.

Between the data relevant macroeconomics:

Friday 21/10/2022

half past one Japan: Consumption prices, annual (previous 3%)

08:00 United Kingdom: Retail sales, annual (expected -5%; previous -5.6%)

08:00 United Kingdom: Retail sales, monthly (expected -0.5%; previous -1.7%)

4:00 pm European Union: Consumer confidence (expected -30 points; prev. -28.8 points)

Monday 24/10/2022

02:30 Japan: Manufacturing PMI (preceding 50.8 points).