(Finance) – Sitting in a rally in Piazza Affari, which aligns with the amazing day of the European stock exchanges. Central banks remain in the spotlight with their moves designed to curb the price rush, now discounted by the markets, while the clouds of a global recession thicken.

The governor of the Banque de France, François Villeroy de Galhau he said that France, but also Europe, will not be immune from a recession, albeit “limited, next year.” The European and French economies will face a significant slowdown next year and we cannot rule out a limited recession ” , the governor said in a speech delivered at an event organized in Prague by the European think tank Eurofi.

On the currency market, plus sign forEuro / US dollar, which shows an increase of 0.70%. L’Gold, on the rise (+ 1.19%), reaches $ 1,726.9 an ounce. Euphoric session for crude oil, with oil (Light Sweet Crude Oil) showing a 1.99% jump.

Uphill it spreadwhich reaches +229 basis points, with an increase of 6 basis points, with the yield of the ten-year BTP equal to 3.97%.

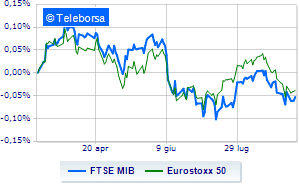

Among the European lists well bought Frankfurtwhich marks a sharp rise of 1.46%, in evidence London, which shows a strong increase of 1.53%; stands out Paris which marks an important progress of 1.59%. In Milan, the FTSE MIB (+ 1.97%), which reaches 22,105 points, continuing the positive streak that began last Tuesday; along the same lines, the FTSE Italia All-Sharewhich with its + 1.9% advances to 24,076 points.

Top of the ranking of the most important titles of Milan, we find Fineco (+ 4.93%), Intesa Sanpaolo (+ 4.86%), Tenaris (+ 4.83%) e BPER (+ 3.63%).

Among the protagonists of the FTSE MidCap, Fincantieri (+ 3.88%), IREN (+ 3.70%), Banca Popolare di Sondrio (+ 3.46%) e MPS Bank (+ 3.43%).

The worst performances, on the other hand, are recorded on Tinextawhich gets -2.79%.

Goes down Antares Visionwith a decline of 2.52%.

Collapses Intercoswith a decrease of 2.30%.

It moves below par Caltagirone SpAshowing a decrease of 0.51%.

Between macroeconomic quantities most important:

Friday 09/09/2022

03:30 China: Consumption prices, annual (expected 2.8%; previous 2.7%)

03:30 China: Production prices, annual (expected 3.1%; previous 4.2%)

08:45 France: Industrial production, monthly (expected -0.5%; previous 1.2%)

4:00 pm USA: Wholesale stocks, monthly (expected 0.8%; previous 1.8%)

Monday 12/09/2022

08:00 United Kingdom: Industrial production, monthly (previous -0.9%).