(Finance) – Difficult day for Piazza Affari, which trades heavilytogether with the other Eurolistini, today orphans of the Wall Street lighthouse which will be closed for the Labor Day holiday.

To weigh on European stock exchanges in the grip of gas is Gazprom’s decision to keep the Nord Stream gas pipeline closed indefinitely. The news sent gas prices soaring to the Amsterdam market and at the same time drove the euro below $ 0.99, with the market fearing for the stability of the European economy. The price of oil is running in view of the expected cut in production by the OPEC + countries, to keep the prices of black gold high.

On the currency market, sitting fractionally lower due to theEuro / US dollar, which for now leaves 0.29% on the parterre. L’Gold the session continues at the levels of the day before, reporting a variation of + 0.13%. Rain of purchases on oil (Light Sweet Crude Oil), which shows a gain of 2.82%.

Jump up it spreadpositioning itself at +239 basis points, with an increase of 8 basis points, with the yield of the ten-year BTP equal to 3.96%.

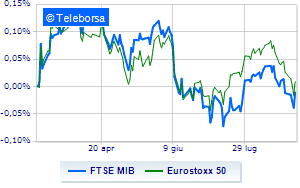

Among the markets of the Old Continent heavy Frankfurtwhich marks a decline of well -2.61 percentage points, subdued London showing a filing of 0.66%; negative session for Paris, which falls by 1.82%. Session to forget for the Italian stock exchange, with the FTSE MIB which is leaving 2.42% on the ground; along the same line, the FTSE Italia All-Sharewhich continues the session at 23,351 points.

Among the best Blue Chips of Piazza Affari, modest performance for Tenaris, which shows a moderate rise of 0.88%. Resistant ENIwhich marks a small increase of 0.70%.

The strongest falls, on the other hand, occur on Interpumpwhich continues the session with -4.94%.

Sensitive losses for Camparidown 4.71%.

Breathless Pirelliwhich falls by 4.21%.

Thud of BPERwhich shows a fall of 4.21%.

Top of the ranking of mid-cap stocks from Milan, Caltagirone SpA (+ 3.95%), Wiit (+ 1.17%), BF (+ 1.13%) e Salcef Group (+ 0.70%).

The strongest sales, on the other hand, show up on ERGwhich continues trading at -6.03%.

Letter on OVSwhich records a significant decline of 5.16%.

Sales on MPS Bankwhich recorded a drop of 5.09% after the ECB’s ok to the capital increase.

Between macroeconomic variables heavier:

Monday 05/09/2022

02:45 China: PMI services Caixin (expected 54 points; precedent 55.5 points)

10:00 European Union: PMI services (expected 50.2 points; preceding 51.2 points)

10:00 European Union: Composite PMI (expected 49.2 points; preceding 49.9 points)

11:00 am European Union: Retail sales, monthly (expected 0.4%; previous -1%)

11:00 am European Union: Retail sales, annual (expected -0.7%; previous -3.2%).