(Finance) – Effervescent Lululemon Athleticawhich trades with a decidedly positive performance of 10.05%.

The Vancouver-based sportswear retailer benefits from the second quarter results they highlight net profits up to 289.5 million ($ 2.26 per share) from 208.1 million (equal to $ 1.59) and against the $ 1.86 estimated by analysts. On an adjusted basis EPS stood at $ 2.20. THE revenues they rose by 29% to 1.87 billion and compare with the 1.77 billion estimated by the consensus. Lululemon improved its full-year revenue guidance from $ 7.61-7.71 to $ 7.87-7.94 billion.

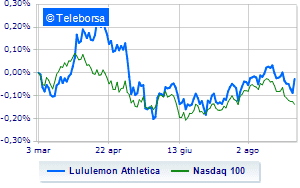

Comparing the performance of the stock with the Nasdaq 100on a weekly basis, we note that Lululemon Athletica maintains positive relative strength in comparison with the index, demonstrating greater appreciation by investors compared to the index itself (weekly performance + 0.21%, compared to -5.42% of theUS technology stock index).

The technical framework of Lululemon Athletica suggests an extension of the bearish line towards the floor at USD 319.7 with the ceiling represented by the 329 area. The forecasts are for an extension of the negative phase to the test of new lows identified at 315.4 level.