(Finance) – Brilliant business square, which is in line with the excellent performance of the main European stock exchanges. Money on the US stock exchange, where theS & P-500 it recorded an increase of 1.11% thanks to data on the labor market which showed a rise in unemployment in the United States, and the market is hoping for a less aggressive central bank on interest rates, to fight high inflation.

On the currency market, positive session for theEuro / US dollar, which is taking home a gain of 0.80%. L’Gold, on the rise (+ 1.1%), reaches $ 1,714.1 per ounce. Strong rise for oil (Light Sweet Crude Oil), which posted a gain of 1.94%.

Slight improvement of the spreadwhich drops to +231 basis points, with a decrease of 4 basis points, while the yield of the 10-year BTP stands at 3.83%.

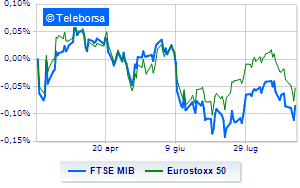

Among the main European stock exchanges shines Frankfurtwith a strong increase (+ 3.33%), excellent performance for London, which registers an increase of 1.86%; exploit of Paris, which shows a rise of 2.21%. A day of strong earnings for Piazza Affari, with the FTSE MIB up by 2.91%, breaking the negative streak that began last Friday, while, on the contrary, a negative day for the FTSE Italia All-Sharewhich closes the session at 23,287 points, down by 1.24%.

At the close of the Milan Stock Exchange, the exchange value in today’s session it was equal to 1.44 billion euro, a marked decrease (-35.85%), compared to the previous session which had seen the negotiation of 2.25 billion euro; while the volumes traded went from 0.59 billion shares of the previous session to today’s 0.42 billion.

Between best Italian stocks large cap, high Exor (+ 6.29%).

Shopping hands-on Banco BPMwhich boasts an increase of 5.20%.

Effervescent Mediolanum Bankwith an increase of 4.75%.

Glowing CNH Industrialwhich boasts a strong increase of 4.64%.

Between best stocks in the FTSE MidCap, MPS Bank (+ 4.87%), Reply (+ 4.34%), Banca Popolare di Sondrio (+ 3.93%) e Maire Tecnimont (+ 3.87%).

The worst performances, on the other hand, were recorded on Caltagirone SpAwhich closed at -3.80%.

Letter on Saraswhich records a significant decline of 3.27%.

Goes down Wiitwith a fall of 2.78%.

Prey of the sellers Secowith a decrease of 1.90%.

Among macroeconomic appointments which will have the greatest influence on market trends:

Friday 02/09/2022

08:00 Germany: Trade balance (4.8 billion euro expected; previous 6.2 billion euro)

11:00 am European Union: Production prices, monthly (expected 2.5%; previous 1.3%)

11:00 am European Union: Production prices, annual (expected 35.8%; previous 36%)

14:30 USA: Unemployment rate (expected 3.5%; previous 3.5%)

14:30 USA: Change in employees (expected 300K units; previous 477K units).