(Finance) – Wall Street moves in fractional decline, starting the month of September on weak tones, reflecting the concerns about a possible recession, caused by the restrictive policies of central banks, the impact of inflation, the continuous lockdowns in China and the war in Ukraine.

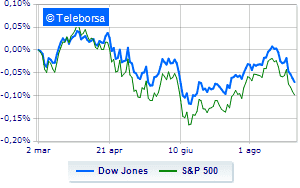

The Dow Jones also today it leaves 0.59% on the parterre, continuing on the downward trend represented by five consecutive drops since last Friday; moves in reverse theS & P-500, which slips to 3,926 points. In red the Nasdaq 100 (-0.95%); as well as, in fractional decline theS&P 100 (-0.6%).

Strong nervousness and generalized losses in the S&P 500 across all sectors, without exclusion. In the lower part of the S&P 500 ranking, significant falls are manifested in the sectors power (-1.98%), materials (-1.66%) e informatics (-1.20%).

Bad day for all the Dow Jones Blue Chips, which show a negative performance.

The strongest falls occur on Boeingwhich continues the session with -3.33%.

Bad performance for DOWwhich recorded a drop of 2.06%.

American Express drops by 1.76%.

Decline for Caterpillarwhich marks a -1.69%.

Between best performers of the Nasdaq 100, Meta Platforms (+ 1.06%) e Alphabet (+ 0.64%).

The worst performances, on the other hand, are recorded on Oktawhich gets -28.88%.

Black session for Datadogwhich leaves a loss of 5.46% on the table.

At a loss Nvidiawhich falls by 5.00%.

Heavy Lululemon Athleticawhich marks a drop of -3.96 percentage points.