(Finance) – Trades lower for the New York Stock Exchange, after an upward start and a subsequent move into negative territory, with investors unable to recover from Jackson Hole. The market continues to discount the policy of high rates with its recessive effect on the stars and stripes economy.

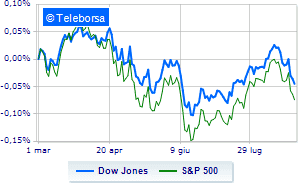

The Dow Jones accuses a decline of 0.76% continuing the series of three consecutive declines, which began last Friday; on the same line, a bad day for theS & P-500, which continues the session at 3,995 points, down 0.89%. Down the Nasdaq 100 (-1.09%); as well, in red theS&P 100 (-0.88%).

All the S&P 500 sectors are down on Wall Street. Among the most negative of the S&P 500 basket list, we find the sectors power (-3.32%), materials (-1.34%) e industrial goods (-1.21%).

All the Dow Jones Blue Chips are losing ground on Wall Street.

The strongest sales show up on Chevronwhich continues trading at -2.87%.

At a loss Caterpillarwhich drops by 2.57%.

Heavy 3Mwhich marks a drop of as much as -2.09 percentage points.

Negative sitting for DOWwhich falls by 1.88%.

All the Nasdaq-100 securities they are below par.

The strongest declines occur on Baiduwhich continues the session with -7.68%.

Sensitive losses for Luciddown 6.59%.

Breathless CSXwhich fell by 2.64%.

Thud of Astrazenecawhich shows a drop of 2.54%.

Between macroeconomic variables most important in the North American markets:

Tuesday 30/08/2022

15:00 USA: FHFA house price index, monthly (expected 0.8%; previous 1.3%)

15:00 USA: S&P Case-Shiller, annual (expected 19.5%; previous 20.5%)

4:00 pm USA: Consumer confidence, monthly (97.9 points expected; previous 95.3 points)

Wednesday 31/08/2022

14:15 USA: ADP busy (expected 200K units; previous 128K units)

14:15 USA: Employed ADP.