(Finance) – Subdued departure for the Wall Street stock exchange awaiting the words of Jerome Powell speaking at the Jackson Hole symposium today. The Fed governor is expected to confirm the need for further US interest rate hikes to fight high inflation, echoing recent comments from other officials on the eve.

Meanwhile, on the macro front, prices in the United States remain at high levels, but in July the ‘core’ figure fell slightly compared to June. The Fed’s preferred measure to calculate it, the personal consumption expenditures price index (PCE), fell by 0.1% compared to the previous month and grew by 6.3% compared to a year earlier.

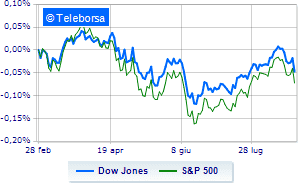

Among the US indices, the Dow Jones the session continues at the levels of the day before, reporting a variation of + 0.18%; on the same line, theS & P-500, which continues the day at 4,200 points. On parity the Nasdaq 100 (-0.05%); as well, without direction theS&P 100 (+ 0.04%).

All the S&P 500 sectors are down on Wall Street.

Between protagonists of the Dow Jones, JP Morgan (+ 1.09%), Boeing (+ 0.94%), Salesforce (+ 0.92%) e DOW (+ 0.90%).

On the podium of the Nasdaq titles, Workday (+ 8.85%), Electronic Arts (+ 4.75%), JD.com (+ 2.85%) e Modern (+ 1.81%).

The strongest falls, on the other hand, occur on Seagenwhich continues the session with -8.45%.

Heavy Marvell Technologywhich marks a drop of -3.93 percentage points.

Negative sitting for Dollar Treewhich falls by 2.06%.

The negative performance of Alphabetwhich falls by 1.77%.

Between macroeconomic quantities most important of the US markets:

Friday 08/26/2022

14:30 USA: Wholesale stocks, monthly (expected 1.4%; previous 1.8%)

14:30 USA: Personal expenses, monthly (expected 0.4%; previous 1%)

14:30 USA: Personal income, monthly (expected 0.6%; previous 0.7%)

4:00 pm USA: University of Michigan Consumer Confidence (expected 55.2 points; preceded 51.5 points)

Tuesday 30/08/2022

15:00 USA: FHFA house price index, monthly (previous 1.4%).