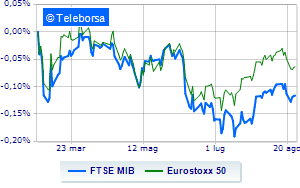

(Finance) – It closes under the banner of caution the session of the main European stock exchanges. The Milan stock exchange also aligns itself with the caution that reigns in Europe, and ends on the parity line. Meanwhile on the American market theS & P-500 it moves just above the parity of 0.58%.

The markets are waiting for the Fed’s annual economic symposium in Jackson Hole, in which President Powell will speak tomorrow (at 4 pm Italian time). Meanwhile, ECB Governing Council minutes in July confirmed the possibility that a further rate hike in September could be less far-reaching than the 50 basis points agreed last month.

On the currency market, theEuro / US dollar the session continues at the levels of the day before, reporting a variation equal to -0.04%. L’Gold shows a timid gain, with an increase of 0.23%. Oil (Light Sweet Crude Oil) down (-0.63%) stood at $ 94.29 per barrel.

The Spread improves, reaching +223 basis points, with a decrease of 8 basis points compared to the previous value, with the yield of the ten-year BTP equal to 3.55%.

Among the Euroland indices moderate earnings for Frankfurtwhich is up by 0.39%, a cautious trend for London, which shows a performance of + 0.11%; little moved Paris, which shows a -0.08%. No significant change in closing for the Milanese list, with the FTSE MIB which stood on the eve of 22,454 points; on the same line, the FTSE Italia All-Shareclosing on 24,533 points.

At the end of the session of the Milan Stock Exchange, it appears that the exchange value in today’s session it was equal to 1.34 billion euro, up 4.46% compared to the previous 1.29 billion; while the volumes traded went from 0.43 billion shares of the previous session to today’s 0.48 billion.

Top of the ranking of the most important titles of Milan, we find ENI (+ 2.06%), Tenaris (+ 1.84%), Exor (+ 1.78%) e CNH Industrial (+ 1.74%).

Stronger sales, on the other hand, fell on Saipemwhich ended trading at -4.63%.

Breathless Banco BPMwhich fell by 2.49%.

Under pressure Nexiwith a sharp drop of 2.49%.

Thud of Ivecowhich shows a drop of 2.09%.

Top of the ranking of mid-cap stocks from Milan, Datalogic (+ 7.29%), Alerion Clean Power (+ 4.94%), GVS (+ 3.68%) e ERG (+ 2.36%).

The strongest declines, on the other hand, occurred on Saraswhich closed the session at -5.89%.

Letter on De ‘Longhiwhich records a significant decrease of 2.72%.

Suffers MPS Bankwhich shows a loss of 2.61%.

Goes down Ariston Holdingwith a decrease of 2.18%.

Between the data relevant macroeconomics:

Thursday 25/08/2022

08:00 Germany: GDP, quarterly (0% expected; previous 0.2%)

9:00 am Spain: Production prices, annual (previous 43.1%)

10:00 Germany: IFO Index (86.8 points expected; preceding 88.7 points)

14:30 USA: GDP, quarterly (expected -0.8%; previous -1.6%)

14:30 USA: Unemployment Claims, Weekly (Expected 253K Units; Previously 245K Units).