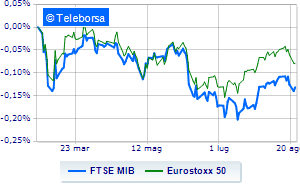

(Finance) – It moves under the banner of caution the session of the main European stock exchanges. with investors’ eyes on the Jackson Hole meeting scheduled from tomorrow until August 27th. Friday 26th the intervention of the Fed number one, Jerome Powell to get more indications on the extent of the rate hike that the US central bank could announce at the September meeting.

On the currency market, weak session for theEuro / US dollar, which trades with a drop of 0.24%. Substantially stable thegold, which continues the session on the eve of the levels at 1,749.9 dollars an ounce. Plus sign for oil (Light Sweet Crude Oil), up 1.19%.

Consolidate the levels of the eve it spreadsettling at +231 basis points, with the yield of the ten-year BTP standing at 3.65%.

Among the European lists colorless Frankfurtwhich does not register significant changes compared to the previous session, disappointing London, which lies just below the levels of the eve; without momentum Paris, which trades with a -0.16%. In Milan, the FTSE MIB it is substantially stable and is positioned on 22,343 points; on the same line, colorless the FTSE Italia All-Sharewhich continues the session at 24,418 points, on the eve of the day.

Between best Italian stocks large cap, very positive balance for DiaSorinwhich boasts an increase of 1.63%.

Resistant Tenariswhich marks a small increase of 0.86%.

Recordati advances by 0.62%.

It moves modestly up Is in theshowing an increase of 0.55%.

The strongest falls, on the other hand, occur on Inwitwhich continues the session with -1.87%.

Under pressure Amplifonwhich shows a decrease of 1.63%.

It slips Interpumpwith a clear disadvantage of 1.34%.

In red Pirelliwhich shows a marked decrease of 1.31%.

At the top among Italian stocks a mid cap, ERG (+ 1.40%), Caltagirone SpA (+ 1.33%), Seco (+ 1.28%) e Rai Way (+ 1.19%).

The worst performances, on the other hand, are recorded on MPS Bankwhich gets -2.20%.

The negative performance of Pharmanutrawhich falls by 1.75%.

Mondadori drops by 1.54%.

Decline for Banca Popolare di Sondriowhich marks a -1.46%.

Between macroeconomic variables heavier:

Wednesday 24/08/2022

14:30 USA: Durable goods orders, monthly (expected 0.6%; previous 1.9%)

4:00 pm USA: Home sales in progress, monthly (expected -4%; previous -8.6%)

16:30 USA: Oil stocks, weekly (expected -933K barrels; previously -7.06 Mln barrels)

Thursday 25/08/2022

08:00 Germany: GDP, quarterly (0% expected; previous 0.2%)

9:00 am Spain: Production prices, annual (formerly 43.2%).