(Finance) – Closing of the octave with a marked decline for the European stock exchanges, with Piazza Affari recording the biggest losses. The trend worsened in the afternoon, thanks to the poor performance of Wall Street, and led the lists of the Old Continent to close the day close to the lows of the session. Investors are always frightened by rising inflation,tightening of monetary policy (also due to hawkish comments from FED officials in the past 24 hours) and slowing growth globally.

On the Italian Stock Exchange there was a real thud for bankswhile the sectors also recorded significant declines automotive and gods discretionary goods.

THE German producer prices they recorded their highest increases ever in July, with energy costs continuing to rise due to the war in Ukraine. Record inflation levels have brought the index down British consumer confidence to a new negative record.

Resists sales, even with minimal exchanges, Banca Carigeafter the BoD has approved i consolidated results as at 30 June 2022. The period closed with a negative net result of € 221.1 million, essentially attributable to the recording in the second quarter of significant non-recurring items for a total of € 205.0 million.

Weak session forEuro / US dollar, which trades with a drop of 0.41%. Caution prevails ongold, which continues the session with a slight decrease of 0.45%. Euphoric session for the rawwith oil (Light Sweet Crude Oil) showing a 1.50% jump.

Slight worsening of the spreadwhich rises to +226 basis points, with an increase of 4 basis points, with the yield of 10-year BTPs equal to 3.48%.

Among the Euroland indices negative session for Frankfurtwhich shows a loss of 1.12%, flat Londonwhich holds parity, and under pressure Pariswhich shows a drop of 0.94%.

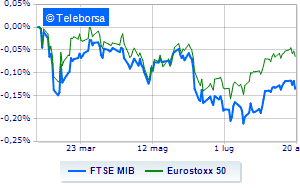

Sales rain on Milanese price list, which ends with a heavy decline of 1.96%; along the same lines, sales on the FTSE Italia All-Share, which closed the day at 24,647 points, a sharp decline of 1.90%. Negative on FTSE Italia Mid Cap (-1.49%); on the same trend, depressed the FTSE Italia Star (-1.87%).

At the end of the session of the Milan Stock Exchange, it appears that the exchange value in today’s session it was equal to 1.2 billion euro, up by 3.45% compared to the previous 1.16 billion; while the volumes traded went from 0.34 billion shares of the previous session to today’s 0.42 billion.

Pink sweater among the stocks of the FTSE MIB to show good earnings, Recordati gets + 2.07%.

Stronger sales, on the other hand, fell on Finecowhich ended trading at -4.77%.

It slips Unicreditwith a clear disadvantage of 3.80%.

Bad performance for Mediobancawhich recorded a drop of 3.72%.

Black session for Interpumpwhich leaves a 3.55% loss on the table.

Top of the ranking of mid-cap stocks from Milan, Datalogic (+ 3.24%), Antares Vision (+ 2.51%), Saras (+ 1.42%) e Fincantieri (+ 0.99%).

Stronger sales, on the other hand, fell on Replywhich ended trading at -3.57%.

At a loss Mutuionlinewhich falls by 3.43%.

Heavy Brembowhich marks a drop of -3.38 percentage points.

Negative sitting for Maire Tecnimontwhich falls by 3.36%.