(Finance) – Session volatile on Wall Streetwhich opens little move, turns down and then recovers supported by purchases on “consumer” securities. In fact, investors find themselves evaluating the quarterly reports of two giants in the retail worldwhose accounts provide information on the consumer behavior. The choices and levels of spending are in fact inevitably impacted by the high level of inflation, which the Fed is still trying to bring under control.

Home Depota US retailer of home maintenance products, confirmed guidance for the whole of 2022 after an above-expected quarter. Walmart, the world’s largest chain in the large-scale retail channel, slightly reduced the expected decline in annual earnings per share after a quarter that beat analysts’ forecasts. Also tomorrow Target will reveal its results.

On the macroeconomic front, they surprised both the positively industrial production that manufacturing in the United States in July 2022. Negative signals have come from building market USA in July 2022, with new construction sites started which recorded a decrease of 9.6%.

Redwire, a US company active in the development of next-generation space infrastructures, has announced that it will launch the first commercial greenhouse into space next year. From communications to the SEC, it emerged that activist investor Politan Capital Management has acquired an 8.4% stake in the medical device manufacturer Masimo.

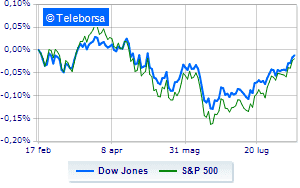

Plus sign for the US price list, with the Dow Jones up 0.70%, continuing the series of five consecutive increases that began last Wednesday; on the same line, theS & P-500 proceeds in small steps, advancing to 4,307 points.

Just below parity the Nasdaq 100 (-0.25%); just above parity theS&P 100 (+ 0.27%).

Sectors stand out in the S&P 500 basket secondary consumer goods (+ 1.42%), consumer goods for the office (+ 1.27%) e financial (+ 0.74%). The sector informaticswith its -0.42%, it is the worst of the market.

To the top between giants of Wall Street, Wal-Mart (+ 5.77%), Home Depot (+ 5.15%), IBM (+ 1.56%) e Walgreens Boots Alliance (+ 1.36%).

The worst performances, on the other hand, are recorded on Salesforcewhich gets -1.31%.

Undertone 3M which shows a filing of 0.74%.

Disappointing Visawhich lies just below the levels of the eve.

To the top between tech giants of Wall Streetthey position themselves Ross Stores (+ 3.90%), Ebay (+ 1.90%), Costco Wholesale (+ 1.68%) e Marriott International (+ 1.59%).

The strongest falls, on the other hand, occur on Zoom Video Communicationswhich continues the session with -4.86%.

At a loss Modernwhich drops by 4.42%.

Heavy Illuminatewhich marks a drop of -4.21 percentage points.

Negative sitting for Pinduoduo Inc Spon Each Repwhich falls by 3.42%.

Between macroeconomic quantities most important of the US markets:

Tuesday 16/08/2022

14:30 USA: Building permits (1.65 million units expected; previous 1.7 million units)

14:30 USA: Opening of construction sites (expected 1.54 million units; previous 1.6 million units)

15:15 USA: Industrial production, annual (previous 4.2%)

15:15 USA: Industrial production, monthly (expected 0.3%; previous -0.2%)

Wednesday 17/08/2022

14:30 USA: Retail sales, monthly (expected 0.1%; previous 1%).