(Finance) – After a positive start, Wall Street shows an uncertain trend. Today is lacking in significant macroeconomic data, with investors having their eyes on the inflation data on Wednesday (referring to the month of July). The trend in consumer prices will take on even more weight after the strong labor market report that was released last Friday. The addition of over 500,000 non-farm payslips supports a aggressive stance by the Federal Reserve in the fight against inflation.

Among the main companies that have spread the quarterly, Tyson Foods reported revenue growth beyond expectations in the last quarter, while Palantir lowered full 2022 guidance after a loss-making second quarter.

On front M&A, Emerson has entered into an agreement to sell the InSinkErator unit to Whirlpool for $ 3 billion, Pfizer will acquire Global Blood Therapeutics in deals worth $ 5.4 billion e UPS the expansion in healthcare will continue by acquiring the Italian Bomi Group.

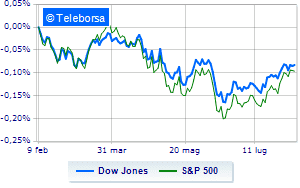

Wall Street continues the session at the levels of the evereporting a variation of + 0.03% on Dow Jones; on the same line, theS & P-500 (New York), which is positioned at 4,142 points, close to the previous levels. Below parity the Nasdaq 100, which shows a decline of 0.30%; on the same line, slightly negative theS&P 100 (-0.2%).

Secondary consumer goods (+ 0.79%), materials (+ 0.76%) e power (+ 0.75%) in good light on the S&P 500 list sector informaticswith its -0.95%, it is the worst of the market.

Among the best Blue Chips of the Dow Jones, Walt Disney (+ 2.49%), DOW (+ 1.94%), Walgreens Boots Alliance (+ 1.17%) e Travelers Company (+ 1.04%).

The strongest falls, on the other hand, occur on McDonald’swhich continues the session with -1.42%.

Sales focus on Visawhich suffers a decline of 1.15%.

It moves below par Cokeshowing a decrease of 0.95%.

Moderate contraction for Verizon Communicationwhich suffers a drop of 0.90%.

On the podium of the Nasdaq titles, Atlassian (+ 5.82%), Lucid (+ 5.18%), Zscaler (+ 4.53%) e Docusign (+ 4.42%).

The strongest falls, on the other hand, occur on Nvidiawhich continues the session with -7.97%.

Breathless Pinduoduo Inc Spon Each Repwhich falls by 4.98%.

Thud of JD.comwhich shows a fall of 4.80%.

Letter on Marvell Technologywhich records a significant decline of 4.50%.

Between the data relevant macroeconomics on US markets:

Tuesday 09/08/2022

14:30 USA: Unit labor cost, quarterly (expected 9%; previous 12.6%)

14:30 USA: Productivity, quarterly (expected -4.6%; previously -7.3%)

Wednesday 10/08/2022

14:30 USA: Consumption prices, annual (expected 8.7%; previous 9.1%)

14:30 USA: Consumption prices, monthly (expected 0.2%; previous 1.3%)

4:00 pm USA: Wholesale stocks, monthly (expected 1.9%; previous 1.9%).