(Finance) – Last session of the week without major shocks for the European stock exchanges, with Piazza Affari remaining close to parity. The movements of the individual securities, which respond to the quarterly outgoing and estimates for the second half of the year, where there are “clouds on the horizon, especially for the energy crisis, and also in general for a significant slowdown in the rest of the world, they are worrying for the future”, said Prime Minister Mario Dragons. On the macroeconomic front, the Italian industrial production it was down in June and worse than expected, while the same indicator surprised positively in Spain, France and Germany.

On the Italian Stock Exchange the performances stand out from BPERwhich in the first half of the year achieved better than expected results thanks above all to the performance of core revenues (highly appreciated by analysts), and Pirelliwhich has revised up the guidance on revenues for the full year after a first half with double-digit growth in revenues and profits.

In the banking world they suffer Illimitydespite the best second quarter ever in terms of new business volumes and growing profit, e MPS, which recorded a lower tule in the first half of 2022 and communicated new out-of-court claims for € 1.8 billion. On parity Banca Popolare di Sondriowhich closed the first half of 2022 with a positive net result for the period of 105.1 million euros (-23.1%).

Yolo Groupone of the main operators in the Italian insurtech market, is listed on the professional segment of Euronext Growth Milan.

L’Euro / US dollar it is basically stable and stops at 1.023. Caution prevails ongold, which continues the session with a slight decrease of 0.24%. Sitting in fractional decline for the Petroleum (Light Sweet Crude Oil), which leaves 0.61% on parterre for now.

Improve it spread (differential between the yield of the BTP and that of the German Bund), falling to +205 basis points, with the yield of Ten-year BTP which is positioned at 2.83%.

Among the markets of the Old Continent without cues Frankfurtwhich does not show significant changes in prices, firm Londonwhich marks almost nothing, and subdued Paris which shows a filing of 0.49%.

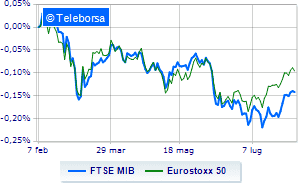

TO Milanthe FTSE MIB is substantially stable and is positioned on 22,613 points, while, on the contrary, it yields to sales the FTSE Italia All-Share, which falls back to 24,762 points. Downhill the FTSE Italia Mid Cap (-0.78%); on the same trend, slightly down on FTSE Italia Star (-0.54%).

Between best performers of Milan, in evidence BPER (+ 9.00%), Pirelli (+ 3.67%), Telecom Italia (+ 2.27%) e Saipem (+ 1.42%).

The strongest sales, on the other hand, show up on Tenariswhich continues trading at -3.25%.

The negative performance of Banca Generaliwhich falls by 2.00%.

Terna drops by 1.93%.

Decline for Campariwhich marks a -1.82%.

Among the protagonists of the FTSE MidCap, Carel Industries (+ 6.87%), Safilo (+ 5.78%), Italmobiliare (+ 1.34%) e Credem (+ 1.24%).

The strongest sales, on the other hand, show up on Saraswhich continues trading at -9.83%.

At a loss Illimity Bankwhich falls by 7.55%.

Under pressure MPS Bankwith a sharp fall of 7.24%.

Heavy Datalogicwhich marks a drop of -3.53 percentage points.

Between the data relevant macroeconomics:

Friday 05/08/2022

half past one Japan: Real household expenses, monthly (expected 0.2%; previous -1.9%)

08:00 Germany: Industrial production, monthly (expected -0.3%; previous -0.1%)

08:45 France: Employment, quarterly (previous 0.3%)

08:45 France: Industrial production, monthly (expected -0.2%; previous 0.2%)

08:45 France: Current items (formerly -3.7 billion euros).