(Finance) – Weak day for Expediawhich changed hands with a drop of 0.72%.

The leader in online travel bookings closed the second quarter with a reduced loss from $ 301 million, or $ 2.02 per share, to $ 185 million ($ 1.17 per share). On an adjusted basis, EPS climbed from $ 1.13 to $ 1.96 above the consensus $ 1.56. THE revenues they rose from 2.11 to 3.18 billion compared to the 2.99 billion expected by analysts.

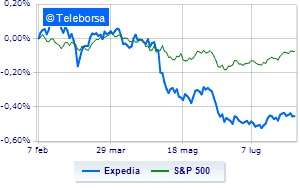

The technical scenario seen at one week of the stock compared to the index S & P-500highlights a slowdown in the trend of Expedia compared toUS basketball indexand this makes the stock a potential target for sale by investors.

The medium-term implications of Expedia confirm the presence of an uptrend. However, the short-term scenario highlights a depletion of positive strength at the resistance test identified at USD 105.9 with first support seen at 98.65. Expectations are for a negative extension in the suitably short time frame towards 95.84.