(Finance) – The Wall Street stock exchange continues the session at the levels of the eve, with investors on the one hand encouraged by some positive quarterly reports that bode well for companies even in a context of high inflation and economic slowdown.

On the other hand, insiders move cautiously in the light of a complex macroeconomic scenario. The indicator preferred by the Federal Reserve to measure inflation, the PCE index, jumped in June to the highest level recorded in 12 months, in over 40 years. Personal incomes and consumer spending rose, both beating analysts’ forecasts. These are economic data coming in the aftermath of the disappointing first reading of GDP: in the second quarter the US economy contracted for the second time in a row considered by economists “technical recession”.

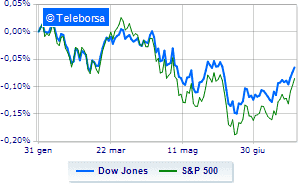

Among the US indices, the Dow Jones shows a variation of + 0.05%, while, on the contrary, theS & P-500 advances fractionally, reaching 4,096 points. Positive the Nasdaq 100 (+ 0.88%); on the same line, in money theS&P 100 (+ 0.81%).

The sub-funds are highlighted on the North American S&P 500 list secondary consumer goods (+ 3.00%), power (+ 2.58%) e informatics (+ 0.74%). Among the most negative on the list of the S&P 500 basket, we find the sectors consumer goods for the office (-1.06%) e sanitary (-0.46%).

To the top between giants of Wall Street, Chevron (+ 5.53%), Apple (+ 2.88%), Caterpillar (+ 1.40%) e Travelers Company (+ 0.79%).

The strongest sales, on the other hand, show up on Intelwhich continues trading at -10.50%.

Collapses Procter & Gamblewith a decrease of 4.59%.

In red Boeingwhich shows a marked decline of 1.75%.

The negative performance of Cisco Systemswhich falls by 1.48%.

Between best performers of the Nasdaq 100, Amazon (+ 10.65%), Datadog (+ 3.92%), Apple (+ 2.88%) e Modern (+ 2.68%).

The worst performances, on the other hand, are recorded on Intelwhich gets -10.50%.

Sales hands on Dexcomwhich suffers a decrease of 8.24%.

Bad performance for Baiduwhich recorded a decline of 5.61%.

Black session for JD.comwhich leaves a loss of 4.76% on the table.

Between the data relevant macroeconomics on US markets:

Friday 29/07/2022

14:30 USA: Labor cost index, quarterly (expected 1.2%; previous 1.4%)

14:30 USA: Personal income, monthly (expected 0.5%; previous 0.6%)

14:30 USA: Personal expenses, monthly (expected 0.9%; previous 0.3%)

15:45 USA: PMI Chicago (expected 55 points; precedent 56 points)

4:00 pm USA: University of Michigan Consumer Confidence (expected 51.1 points; preceded 50 points).