(Finance) – The main stock exchanges of the Old Continent were all positive in the last session of July, supported by the quarterly reports and by the positive signals coming from the GDP of the euro area. In the background, fears of high inflation remain. Meanwhile, the New York square is positive with theS & P-500which marks an increase of 0.83%.

On the currency market, theEuro / US dollar, which trades on the eve of 1.021. Slight increase forgold, which shows an increase of 0.62%. Strong rise for oil (Light Sweet Crude Oil), which posted a gain of 4.05%.

In marked decline it spreadwhich is positioned at +227 basis points, with a sharp drop of 14 basis points, with the yield of the 10-year BTP standing at 3.04%.

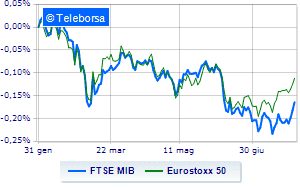

Among the Euroland indices shines Frankfurtwith a strong increase (+ 1.52%), well set London, which shows an increase of 1.06%; excellent performance for Paris, which records a 1.72% progress. Euphoric session for Piazza Affari, with the FTSE MIB which shows a jump of 2.16% at the end, consolidating the series of three consecutive rises, started last Wednesday; on the same line, brilliant day for the FTSE Italia All-Sharewhich ends at 24,537 points.

On the Milan Stock Exchange it appears that the exchange value in today’s session it was equal to 1.98 billion euro, from 1.98 billion in the previous session; while the volumes traded today went from 0.52 billion shares of the previous session to today’s 0.54 billion.

Between best performers of Milan, in evidence Saipem (+ 6.33%), Interpump (+ 6.24%), ENI (+ 5.63%) e Pirelli (+ 5.46%).

The strongest declines, on the other hand, occurred on Leonardowhich closed the session at -7.64%.

Small loss for Amplifonwhich trades with a -0.53%.

Between best stocks in the FTSE MidCap, OVS (+ 6.48%), GVS (+ 5.06%), Mfe A (+ 5.04%) e Wiit (+ 4.44%).

Stronger sales, on the other hand, fell on Saraswhich ended trading at -2.75%.

Bad performance for Alerion Clean Powerwhich recorded a decline of 2.57%.

In red BFwhich shows a marked decrease of 1.39%.

The negative performance of Juventuswhich falls by 1.27%.

Between macroeconomic quantities most important:

Friday 29/07/2022

half past one Japan: Unemployment rate (expected 2.5%; previous 2.6%)

01:50 Japan: Retail sales, annual (expected 2.8%; previous 3.7%)

01:50 Japan: Industrial production, monthly (expected 3.7%; previous -7.5%)

07:30 France: GDP, quarterly (expected 0.2%; previous -0.2%)

08:45 France: Consumption prices, monthly (expected 0.3%; previous 0.7%).