(Finance) – The Wall Street stock exchange is about to close today’s session up, the last of the week and the month of July, after yesterday it emerged that the United States is in a technical recession.

The first reading of the GDP of the second quarter showed that the US economy contracted again after falling in the first quarter. And PCE inflationpreferred size by Federal Reservejumped in June, marking the largest monthly rise since February 1981. But big tech’s positive quarterly reports, such as Apple And Amazon argue Wall Street.

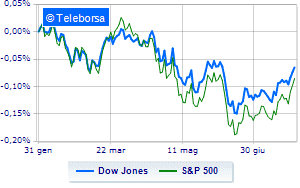

Among the US indices, the Dow Jones it is achieving + 0.54%, continuing the series of three consecutive increases, which began last Wednesday; on the same line, theS & P-500 it gained 0.95% compared to the previous session, trading at 4,111 points. On the rise the Nasdaq 100 (+ 1.04%); along the same line, theS&P 100 (+ 1.17%).

Power (+ 3.83%), secondary consumer goods (+ 3.40%) e industrial goods (+ 1.38%) in good light on the S&P 500 list. Among the worst in the list of the S&P 500 basket, the sectors consumer goods for the office (-0.78%), sanitary (-0.62%) e telecommunications (-0.53%).

Between protagonists of the Dow Jones, Chevron (+ 8.22%), Caterpillar (+ 4.42%), Apple (+ 3.20%) e DOW (+ 1.91%).

The strongest sales, on the other hand, show up on Intelwhich continues trading at -8.93%.

Breathless Procter & Gamblewhich falls by 5.02%.

Suffers Cisco Systemswhich shows a loss of 1.12%.

Prey of the sellers Merckwith a decrease of 1.10%.

Between protagonists of the Nasdaq 100, Amazon (+ 11.11%), Apple (+ 3.20%), KLA-Tencor (+ 3.11%) e Constellation Energy (+ 2.87%).

The strongest sales, on the other hand, show up on Intelwhich continues trading at -8.93%.

Thud of Dexcomwhich shows a fall of 6.36%.

Letter on Comcastwhich records a significant drop of 6.03%.

Goes down JD.comwith a decrease of 4.72%.

Among macroeconomic appointments which will have the greatest influence on the performance of the US markets:

Friday 29/07/2022

14:30 USA: Labor cost index, quarterly (expected 1.2%; previous 1.4%)

14:30 USA: Personal income, monthly (expected 0.5%; previous 0.6%)

14:30 USA: Personal expenses, monthly (expected 0.9%; previous 0.3%)

15:45 USA: PMI Chicago (expected 55 points; precedent 56 points)

4:00 pm USA: University of Michigan Consumer Confidence (expected 51.1 points; preceded 50 points).