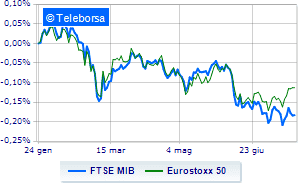

(Finance) – After a weak session opening and a strengthening with highs reached in conjunction with the opening of Wall Street, European markets lost strength at the end of the day and closed on parity. The easing of fears about the energy supply crisis and the absence of negative announcements from the ECB led to a Friday on the stock market with no particular operational cues. In the morning, S&P Global’s Purchasing Managers’ Index (PMI) signaled that eurozone economic activity contracted in July due to the acceleration of the decline in the manufacturing sector and a substantial halt in the growth of the services sector.

Leap for Sogefiwhich closed the first half of 2022 with revenues of 760 million, an increase of 12.3% compared to the first half of 2021. BB Biotecheven though it closed the second quarter with a loss of CHF 233 million.

On Euronext Growth Milan, excellent session for Medical, which last night announced the acquisition of 51% of the share capital of Spindial. Also good Farmaèwhose revenues amounted to € 52.5 million in the first half of 2022.

L’Euro / US dollar the session continues at the levels of the day before, reporting a variation equal to -0.12%. L’Gold shows a timid gain, with a progress of 0.66%. The Petroleum (Light Sweet Crude Oil), up (+ 1.1%), reaches 97.41 dollars per barrel.

Back to climb it spreadreaching +234 basis points, with an increase of 6 basis points, with the yield of Ten-year BTP equal to 3.31%.

Among the markets of the Old Continent without momentum Frankfurtwhich trades with + 0.05%, London it is stable, reporting a moderate + 0.08%, and is moving modestly up Parisshowing an increase of 0.25%.

No significant change in closing for Milanese price listwith the FTSE MIB which stood on the eve of 21,212 points, while, on the contrary, depressed in the final FTSE Italia All-Share, which closes below the levels of the eve at 23,269 points. In money the FTSE Italia Mid Cap (+ 0.97%); with similar direction, the performance of the FTSE Italia Star (+ 1.09%).

The countervalue of exchanges in today’s session on Piazza Affari amounted to 2.6 billion euros, with an increase of 634.8 million euros, equal to 32.23%, compared to the previous 1.97 billion; while the volumes traded went from 0.65 billion shares of the previous session to today’s 0.86 billion.

Top of the ranking of the most important titles of Milan, we find Terna (+ 2.45%), Inwit (+ 2.39%), Banca Generali (+ 2.18%) e Prysmian (+ 2.12%).

The strongest declines, on the other hand, occurred on Unicreditwhich closed the session at -2.35%.

At a loss Telecom Italiawhich falls by 2.04%.

In red Finecowhich shows a marked decline of 1.66%.

The negative performance of Recordatiwhich falls by 1.63%.

Among the protagonists of the FTSE MidCap, Mfe A (+ 4.59%), Saras (+ 4.56%), Saint Lawrence (+ 3.63%) e ENAV (+ 3.03%).

The worst performances, on the other hand, were recorded on Credemwhich closed at -3.98%.

Fincantieri drops by 1.55%.

Decline for Italmobiliarewhich marks a -1.49%.

Under pressure MPS Bankwith a sharp decline of 1.41%.

Between macroeconomic variables heavier:

Friday 22/07/2022

half past one Japan: Consumption prices, annual (previous 2.5%)

02:30 Japan: Manufacturing PMI (preceding 52.7 points)

08:00 United Kingdom: Retail sales, annual (expected -5.3%; previous -4.7%)

08:00 United Kingdom: Retail sales, monthly (expected -0.3%; previous -0.5%)

10:00 European Union: Manufacturing PMI (51 points expected; preceding 52.1 points).