(Finance) – Down Wall Streetafter Twitter and Snap’s quarterly reports triggered sales on the stocks of other social media and other technology companies. Collapses Snap, which reported a loss of $ 422 million for the quarter, as well as slower sales growth, adding that it will “substantially” cut hiring. Between companies that have released quarterly reports today: Twitter released below-expected results, blaming the pending acquisition of Elon Musk and the decline in advertising for disappointing revenue performance. Verizon revised its full-year guidance downward following the slowdown in new customers in the second quarter. AmEx increased its revenue outlook thanks to the strong rebound in travel and entertainment spending in the first half of the year.

On the macroeconomic front, the indices Purchasing Managers Index (PMI) indicated the first contraction of the US economy in over two years.

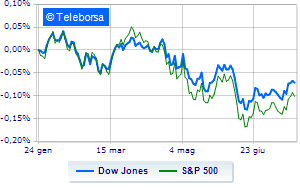

Weak session for the US price listwhich trades with a drop of 0.55% on the Dow Jones, interrupting the series of three consecutive hikes, which began last Tuesday; on the same line, a bad day for theS & P-500, which continues the session at 3,953 points, down 1.14%. Heavy on Nasdaq 100 (-1.99%); on the same trend, negative theS&P 100 (-1.34%).

They stand out in the S&P 500 i basket sectors utilities (+ 0.87%) e consumer goods for the office (+ 0.48%). In the lower part of the S&P 500 ranking, significant falls are manifested in the sectors telecommunications (-4.84%), informatics (-1.61%) e secondary consumer goods (-0.94%).

Between protagonists of the Dow Jones, American Express (+ 2.32%), Procter & Gamble (+ 1.17%), Honeywell International (+ 0.56%) e Amgen (+ 0.53%).

The strongest falls, on the other hand, occur on Verizon Communicationwhich continues the session with -7.68%.

Heavy Intelwhich marks a drop of -3.35 percentage points.

Negative sitting for Nikewhich drops by 2.15%.

Sensitive losses for Boeingdown 2.00%.

Between best performers of the Nasdaq 100, Exelon (+ 1.24%), Automatic Data Processing (+ 1.20%), American Electric Power (+ 1.19%) e Kraft Heinz (+ 1.15%).

The strongest falls, on the other hand, occur on Lucidwhich continues the session with -8.57%.

Breathless Meta Platformswhich fell by 7.83%.

Thud of Datadogwhich shows a fall of 7.24%.

Letter on Align Technologywhich records a significant decline of 6.87%.

Between macroeconomic quantities most important of the US markets:

Friday 22/07/2022

15:45 USA: PMI services (expected 52.6 points; preceding 52.7 points)

15:45 USA: Composite PMI (preceding 52.3 points)

15:45 USA: Manufacturing PMI (expected 52 points; preceding 52.7 points)

Tuesday 26/07/2022

15:00 USA: FHFA house price index, monthly (previous 1.6%)

15:00 USA: S&P Case-Shiller, annual (previous 21.2%).