(Finance) – Volatile session for the Wall Street stock exchange, which started down on the wake of the data on the labor market, subsequently passed into positive territory and then slipped again into negative. The robust June employment report raises investors’ conviction that the Fed is taking an even more aggressive stance to curb inflation, which reinforces fears of a recession.

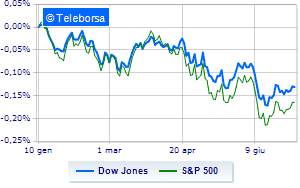

Among the US indices, the Dow Jones the session continued with a slight decrease of 0.21%; on the same line, theS & P-500 it has a depressed trend and is trading below the levels of the eve of 3,890 points. Slightly negative the Nasdaq 100 (-0.45%); with a similar direction, slightly down theS&P 100 (-0.27%).

Positive result in the S&P 500 basket for the sector sanitary. In the list, the worst performances are those of the sectors materials (-0.82%), industrial goods (-0.64%) e informatics (-0.63%).

At the top of the ranking of American giants components of the Dow Jones, United Health (+ 1.86%) e Amgen (+ 0.60%).

The worst performances, on the other hand, are recorded on DOWwhich gets -1.57%.

Sales on Salesforcewhich recorded a decrease of 1.46%.

Negative sitting for Walt Disneywhich shows a loss of 1.39%.

Under pressure Intelwhich shows a decrease of 1.38%.

Between best performers of the Nasdaq 100, Tesla Motors (+ 2.07%), Modern (+ 1.77%), Regeneron Pharmaceuticals (+ 1.56%) e NetEase (+ 1.14%).

The strongest falls, on the other hand, occur on Pinduoduo Inc Spon Each Repwhich continues the session with -3.34%.

Collapses Mercadolibrewith a decrease of 2.69%.

Sales hands on JD.comwhich suffers a decrease of 2.41%.

Bad performance for Paypalwhich recorded a decline of 2.26%.

Among macroeconomic appointments which will have the greatest influence on the performance of the US markets:

Friday 08/07/2022

14:30 USA: Unemployment rate (expected 3.6%; previous 3.6%)

14:30 USA: Change in employees (268K expected; previous 384K)

4:00 pm USA: Wholesale stocks, monthly (previous 2.3%)

Wednesday 13/07/2022

14:30 USA: Consumer prices, annual (expected 8.7%; previous 8.6%)

14:30 USA: Consumption prices, monthly (1% expected; 1% before).