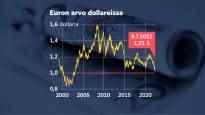

On Friday, the value of the euro fell to within a centimeter of one dollar. The energy crisis hits Europe particularly hard and the dollar has become a safe haven. The weakening of the currency has both good and bad sides.

The value of the euro is weakening, and on Friday its value was already very close to the one dollar limit, i.e. to 1.0084 dollars.

So-called parity, i.e. equality, between the dollar and the euro last existed twenty years ago.

The reason behind the slide of the euro is that the market predicts that the European economy is plunging towards a recession. The position of the dollar as a safe haven is strengthened.

Why is the euro suspicious?

The weakening of the euro is caused by investors moving their capital away from euro-denominated securities. The value of the currency decreases when its demand in the market decreases.

Currency traders estimate the consequences of the Russian attack and the energy crisis for Europe to be greater than for the United States.

The gas crisis in Germany, the largest euro economy, has an effect in the background. Its economy is in dire straits as energy prices rise because it is so dependent on gas.

The risks of indebtedness of southern European countries and rising interest rates due to inflation are also eating away at the value of the euro. The countries’ ability to meet their debt reductions in the future is questionable.

One attractive factor for dollar investments is the interest rate difference between the Eurozone and the United States. The investor gets a return of almost three percent on the US ten-year bond, while the interest rate on the German ten-year bond is just under 1.3 percent at this time.

The US central bank Fed has also expressed that it will continue raising interest rates faster than the European Central Bank. The euro weakens, as the market fears that the European Central Bank will slow down the pace of interest rate hikes due to the risk of a recession in the euro area.

What will be the result of the fall in the value of the euro?

The weakening of the euro has both good and bad sides. The decrease in the external value of the currency improves the competitiveness of Finland’s export industry.

The situation corresponds to the devaluations of the marka era, with which the currency was weakened by a political decision. There is no “need” to devalue now, when indebtedness and rapidly galloping inflation take care of the job.

Most production factors, such as wages, are priced in euros, but sales are usually made in dollars in international trade. Margins on products manufactured by companies in the euro area and sold to, for example, China or the United States are increasing.

However, Finland’s most important export countries are in Europe. For example, in exports to the German market, there is no sign of a decrease in price.

The dark side of the currency’s decline is that the purchasing power of citizens in relation to the rest of the world weakens. Imported products will become more expensive.

On a summer holiday trip outside the euro area, hotels and services are clearly more expensive than before when converted into euros.

You can discuss the topic until Sunday evening at 11 p.m.