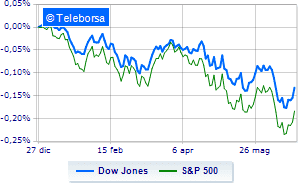

(Finance) – Positive session for Wall Street, which is about to close the week higher, a rarity in the turbulent months that affected the markets in this first part of the year. Investors also find themselves evaluating some macroeconomic data: they increased beyond expectations in May new home sales in the United States, while the index measuring the US consumer confidence – according to the latest survey conducted by the University of Michigan – for the month of June 2022.

The president of the St. Louis FED, James Bullardsaid the Federal Reserve must “act decisively and aggressively to reverse the trend and keep inflation under control “.

Strong earnings day for Wall Streetwith the Dow Jones up by 2.13%; on the same line, it moves with the wind in its sails theS & P-500, which reaches 3,887 points. Effervescent the Nasdaq 100 (+ 2.5%); on the same line, excellent performance of theS&P 100 (+ 2.31%).

Featured on the North American S&P 500 i price list compartments financial (+ 3.44%), industrial goods (+ 3.25%) e telecommunications (+ 3.06%).

At the top of the ranking of American giants components of the Dow Jones, Salesforce (+ 6.50%), Boeing (+ 5.49%), Goldman Sachs (+ 5.40%) e DOW (+ 4.90%).

The worst performances, on the other hand, are recorded on Verizon Communicationwhich gets -1.88%.

Sales focus on United Healthwhich suffers a decline of 1.46%.

On the podium of the Nasdaq titles, AirBnb (+ 7.29%), Workday (+ 6.46%), Meta Platforms (+ 6.14%) e Paypal (+ 5.88%).

The strongest falls, on the other hand, occur on Lucidwhich continues the session with -1.32%.

Sales on Biogenwhich recorded a decline of 1.21%.

Negative sitting for Modernwhich shows a loss of 1.16%.

Lazy day for Gilead Scienceswhich marks a decrease of 0.56%.

Among macroeconomic appointments which will have the greatest influence on the performance of the US markets:

Friday 24/06/2022

4:00 pm USA: Sale of new houses, monthly (previous -12%)

4:00 pm USA: University of Michigan Consumer Trust (50.2 points expected; previous 58.4 points)

Monday 27/06/2022

14:30 USA: Durable goods orders, monthly (previous 0.4%)

4:00 pm USA: Homes sales in progress, monthly (previous -3.9%)

Tuesday 28/06/2022

14:30 USA: Wholesale stocks, monthly (formerly 2.1%).