(Finance) – Positive session for Piazza Affari, driven by defensive stocks, in a day of generalized increases in Europe. The trade remains volatilewith investors always having to evaluate the possible impacts of restrictive monetary policies and galloping inflation on company prospects and economic growth.

Despite positive sessions like today’s, traders show little conviction in a substantial recovery. “In this context, market liquidity may remain scarce and the Investors are driven primarily by the motivation to avoid losses. This can lead to erratic price movements, shifting correlations and swings in sentiment – says Mark Dowding, CIO of BlueBay – Therefore, we believe it is appropriate to keep risk at modest levels. At the same time, we believe it is appropriate to invest with a medium-term mindset, trying to identify the value and of look through the noise amid the volatility“.

The Vice-President of the European Central Bank, Luis de Guindos, denied the rumors that Frankfurt is forced to sell government bonds of one country to offset any new purchases of government bonds of other more indebted countries. “With anti-fragmentation, increasing the budget is not a real problem at all,” said the Spanish economist.

L’Euro / US dollar shows a shy gain, with a progress of 0.35%. L’Gold trading continues with a fractional gain of 0.40%. Strong earnings day for the Petroleum (Light Sweet Crude Oil), up 3.46%.

Small step to the top of the spreadwhich reaches +196 basis points, showing an increase of 4 basis points, with the yield of 10-year BTPs equal to 3.40%.

Among the Euroland indices in the foreground Frankfurtwhich shows a sharp increase of 1.59%, takes off Londonwith a major advance of 2.68%, and in evidence Pariswhich shows a strong increase of 3.23%.

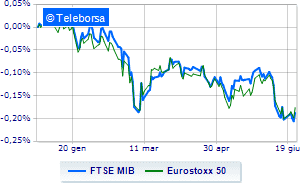

A day of strong earnings for Piazza Affari, with the FTSE MIB up by 2.33%, while, on the contrary, the FTSE Italia All-Sharewhich stops at 23,638 points, retracing by 0.80%.

The FTSE Italia Mid Cap (+ 1.92%); on the same line, the FTSE Italia Star (+ 2.52%).

The countervalue of exchanges in today’s session on Piazza Affari amounted to 2.16 billion euros, with an increase of 363 million euros, equal to 20.16%, compared to the previous 1.8 billion; while the volumes traded went from 0.44 billion shares of the previous session to today’s 0.61 billion.

Between best performers of Milan, in evidence Recordati (+ 7.64%), Interpump (+ 6.64%), Italgas (+ 5.30%) e Moncler (+ 5.00%).

Stronger sales, on the other hand, fell on Saipemwhich ended trading at -21.81%.

Among the protagonists of the FTSE MidCap, GVS (+ 5.85%), Saras (+ 4.77%), Reply (+ 3.78%) e Brunello Cucinelli (+ 3.67%).

The strongest declines, on the other hand, occurred on Ariston Holdingwhich closed the session at -1.73%.

Negative sitting for Cementir Holdingwhich shows a loss of 1.72%.

Lazy day for Carel Industrieswhich marks a decline of 0.81%.

Small loss for Fincantieriwhich trades with a -0.7%.

Between macroeconomic variables heavier:

Friday 24/06/2022

half past one Japan: Consumption prices, annual (previous 2.5%)

08:00 United Kingdom: Retail sales, monthly (expected -0.7%; previous 0.4%)

08:00 United Kingdom: Retail sales, annual (expected -4.5%; previous -5.7%)

9:00 am Spain: GDP, annual (expected 6.4%; previous 5.5%)

9:00 am Spain: GDP, quarterly (0.3% expected; previous 2.2%).