(Finance) – The main stock exchanges of the Old Continent were all positive, with investors’ attention remaining focused on the ECB meeting, scheduled for Thursday, and on the new macroeconomic projections for the Eurozone. Meanwhile, on Wall Street, purchases for theS & P-500awaiting US inflation data Friday afternoon.

On the currency market, slight decline inEuro / US dollar, which drops to 1.07. Weak session forgold, which trades with a drop of 0.35%. Light Sweet Crude Oil, which continues the day at $ 118.6 per barrel.

Slight improvement of the spreadwhich drops up to +209 basis points, with a decrease of 4 basis points, while the yield of the 10-year BTP stands at 3.42%.

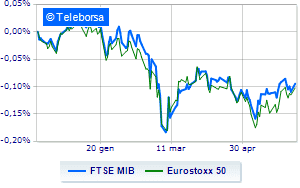

Among the markets of the Old Continent sustained Frankfurtwith a decent gain of 1.34%, good insights on London, which shows a large advantage of 1.00%; well set up Paris, which shows an increase of 0.98%. Strong upside for the Milan stock exchange, with the FTSE MIB, which posted a gain of 1.65%; along the same lines, the FTSE Italia All-Sharewhich with its + 1.55% ends at 26,827 points.

At the close of the Milan Stock Exchange, the turnover in today’s session was equal to 1.28 billion euros, a significant decrease (-13.43%), compared to the previous session which had seen the trading of 1.48 billion euros; while the volumes traded went from 0.38 billion shares of the previous session to today’s 0.34 billion.

At the top of the ranking of the most important titles of Milan, we find Iveco Group (+ 4.70%), Nexi (+ 3.83%), BPER (+ 3.65%) e Intesa Sanpaolo (+ 3.27%).

The worst performances, however, were recorded on Interpumpwhich closed at -1.11%.

Thoughtful Leonardowith a fractional decline of 0.53%.

At the top among Italian stocks a mid cap, Saint Lawrence (+ 4.37%), Seco (+ 3.13%), Sesa (+ 2.94%) e Datalogic (+ 2.33%).

The worst performances, however, were recorded on Antares Visionwhich closed at -5.57%.

Letter on OVSwhich records a significant drop of 2.02%.

Suffers Salcef Groupwhich shows a loss of 1.79%.

Prey of the sellers Pharmanutrawith a decrease of 1.40%.

Between macroeconomic quantities most important:

Tuesday 07/06/2022

half past one Japan: Real household expenses, monthly (expected 1.3%; previous 4.1%)

08:00 Germany: Industry orders, monthly (expected 0.5%; previous -4.7%)

14:30 USA: Balance of trade (expected -89.3 B $; previous -109.8 B $)

Wednesday 08/06/2022

01:50 Japan: GDP, quarterly (expected -0.3%; previous 0.9%)

01:50 Japan: Current items (¥ 511 billion expected; ¥ 2,549.3 billion previously).