(Finance) – Bad day for Wall Streetwith the Nasdaq sinking in conjunction with the increase in the yield of Treasury. It was the report on the labor market released by the Bureau of Labor Statistics. The US economy created 390,000 jobs in May, beyond analysts’ expectations, while the unemployment rate remained stable at 3.6%. A such a strong job market could make the Fed more hawkish and don’t let it falter on its monetary tightening path. In recent weeks, there has been talk of the possibility that the US central bank might consider one pause in rate hikes after June / July hikes, but a strong economy dismisses this possibility.

“The best part of the employment report is the increase in participation, while the bad part is that we still need millions more working to reduce the pervasive shortages that drive inflation. It is. frustrating that the Fed is trying to dampen demand and limit hiring when we need to see a solid set of employment relationships“commented Bryce Doty, senior vice president of Sit Investment Associates.

Tesla it sank after the chief executive officer in an internal email sent to executives Elon Musk he said you have to reduce staff by about 10%explaining that he has a “super bad feeling” about the performance of the economy.

On the front of company announcements, Bristol Myers reached an agreement for buy Turning Point for 4.1 billion dollars. American Airlines raised its revenue estimates for the second quarter of 2022 thanks to strong demand. Lululemon raised guidance after an above-expected first quarter. RH had a strong first quarter but sees a slowdown in demand.

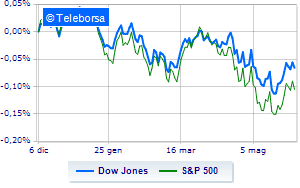

The Dow Jones the session continues with a drop of 0.69%; on the same line, theS & P-500 loses 1.27%, continuing the session at 4,124 points. In net worsening the Nasdaq 100 (-2.25%); with analogous direction, negative theS&P 100 (-1.47%). Significant upside in the S&P 500 for the fund power. At the bottom of the S&P 500 basket ranking, significant declines are manifested in compartments secondary consumer goods (-2.37%), informatics (-2.08%) e telecommunications (-2.01%).

Among the best Blue Chips of the Dow Jones, Caterpillar (+ 1.32%), Chevron (+ 1.12%), IBM (+ 0.76%) e Home Depot (+ 0.59%).

The strongest falls, on the other hand, occur on Applewhich continues the session with -3.48%.

Goes down Intelwith a drop of 2.06%.

Under pressure Walt Disneywhich shows a decline of 1.88%.

It slips Salesforcewith a clear disadvantage of 1.57%.

Between protagonists of the Nasdaq 100, Okta (+ 6.62%), Seagen (+ 3.25%), Biogen (+ 2.63%) e Constellation Energy (+ 2.59%).

The strongest sales, on the other hand, show up on Tesla Motorswhich continues trading at -8.17%.

Collapses Micron Technologywith a decrease of 6.81%.

Sales hands on Crowdstrike Holdingswhich suffers a decrease of 6.19%.

Bad performance for Lucidwhich recorded a drop of 5.81%.

Between macroeconomic variables most important in the North American markets:

Friday 03/06/2022

14:30 USA: Change in employment (325K units expected; previous 436K units)

14:30 USA: Unemployment rate (expected 3.5%; previous 3.6%)

15:45 USA: Composite PMI (expected 53.8 points; preceding 56 points)

15:45 USA: PMI services (expected 53.5 points; preceding 55.6 points)

4:00 pm USA: ISM non-manufacturing (56.4 points expected; preceding 57.1 points).