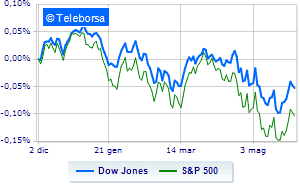

(Finance) – Weak session for the US price listwhich trades with a drop of 0.59% on the Dow Jones; on the same line, with a slight decrease inS & P-500, which continues the day below par at 4,103 points. Down the Nasdaq 100 (-0.74%); as well as the S&P 100 just below par (-0.52%).

To penalize the American market i solid ISM manufacturing datawhich herald more aggressive interest rate hikes, while the Canadian central bank followed in the footsteps of the Fed and raised the cost of money to 1.5%. More about the US economy will tell tonight the Beige Book.

The sector is highlighted on the North American S&P 500 list power. At the bottom of the ranking, the largest falls are manifested in the sectors consumer goods for the office (-1.64%), sanitary (-1.60%) e financial (-1.41%).

To the top between giants of Wall Street, Salesforce (+ 10.68%), Chevron (+ 1.29%), DOW (+ 0.84%) e Caterpillar (+ 0.79%).

The strongest sales, on the other hand, show up on Wal-Martwhich continues trading at -2.86%.

In red Goldman Sachswhich shows a marked decline of 1.97%.

The negative performance of Boeingwhich falls by 1.91%.

Amgen drops by 1.79%.

Between best performers of the Nasdaq 100, Datadog (+ 2.37%), Amazon (+ 2.15%), Constellation Energy (+ 2.05%) e Paccar (+ 1.19%).

The strongest sales, on the other hand, show up on Intuitive Surgicalwhich continues trading at -5.70%.

Bad performance for Dexcomwhich recorded a drop of 5.44%.

Black session for Idexx Laboratorieswhich leaves a loss of 4.75% on the table.

At a loss Align Technologywhich falls by 4.46%.