(Finance) – Piazza Affari does not move from the values of the eve, in line with the main markets of Euroland. European stock exchanges have lost ground since the opening, which had shown good gains. Investors’ attention is on numerous macroeconomic data released in the morningwith Italy’s April unemployment rate remaining stable at 8.4%, the Italian manufacturing sector growing at the slowest pace in over a year and a half in May, and the eurozone unemployment rate for April it remained stable at 6.8%.

Among the companies that have carried out ads before the market opens, it moves significantly lower Saipem (which reversed direction from a very strong opening), after it announced the sale of the onshore drilling activities to KCAD for $ 550 million. Positive Nexi And BPERafter the former has signed an agreement to take over from the latter (and from the subsidiary Banco di Sardegna) the merchant acquiring and POS management activities.

L’Euro / US dollar it is basically stable and stops at 1.072. Sitting in fractional reduction for thegold, which for now leaves 0.35% on the parterre. Oil (Light Sweet Crude Oil), on the rise (+ 1.46%), reaches 116.3 dollars per barrel.

On the levels of the eve it spreadwhich remained at +199 basis points, with the yield on the ten-year BTP standing at 3.11%.

In the European stock market scenario resistant Frankfurtwhich marks a small increase of 0.22%, thoughtfully Londonwith a fractional drop of 0.20%, and little moved Pariswhich shows a + 0.17%.

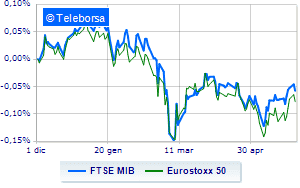

The Milan Stock Exchange stops on parity, with the FTSE MIB which stands at 24,533 points; on the same line, colorless the FTSE Italia All-Sharewhich continues the session at 26,786 points, on the eve of the day.

Below parity the FTSE Italia Mid Cap, which shows a decrease of 0.40%; as well, the slightly negative FTSE Italia Star (-0.69%).

Between best performers of Milan, in evidence Stellantis (+ 2.14%), BPER (+ 1.98%), Leonardo (+ 1.95%) e Pirelli (+ 1.28%).

The strongest sales, on the other hand, show up on Saipemwhich continues trading at -2.20%.

Ferrari drops by 1.93%.

Decline for Prysmianwhich marks a -1.7%.

Under pressure Amplifonwith a sharp decline of 1.65%.

Between best stocks in the FTSE MidCap, OVS (+ 3.51%), Credem (+ 1.99%), Saint Lawrence (+ 1.90%) e Italmobiliare (+ 1.82%).

The strongest falls, on the other hand, occur on Replywhich continues the session with -3.16%.

Sales hands on SOLwhich suffers a decrease of 3.08%.

Bad performance for Alerion Clean Powerwhich recorded a decline of 3.06%.

Black session for Antares Visionwhich leaves a loss of 2.85% on the table.

Between macroeconomic quantities most important:

Wednesday 01/06/2022

02:30 Japan: Manufacturing PMI (expected 53.2 points; preceding 53.5 points)

08:00 Germany: Retail sales, annual (4% expected; previous -1.7%)

08:00 Germany: Retail sales, monthly (expected -0.2%; previous 0.9%)

10:00 European Union: Manufacturing PMI (expected 54.4 points; preceding 55.5 points)

11:00 am European Union: Unemployment rate (expected 6.8%; previous 6.8%).