The exceptional purchasing power bonus, also called the “Macron bonus” or PEPA, will be tripled for employees in the private sector, the Council of Ministers confirmed on May 11. This “without taxes or charges”. Who can benefit ? What amount? From 1000 to 6000 euros? Info.

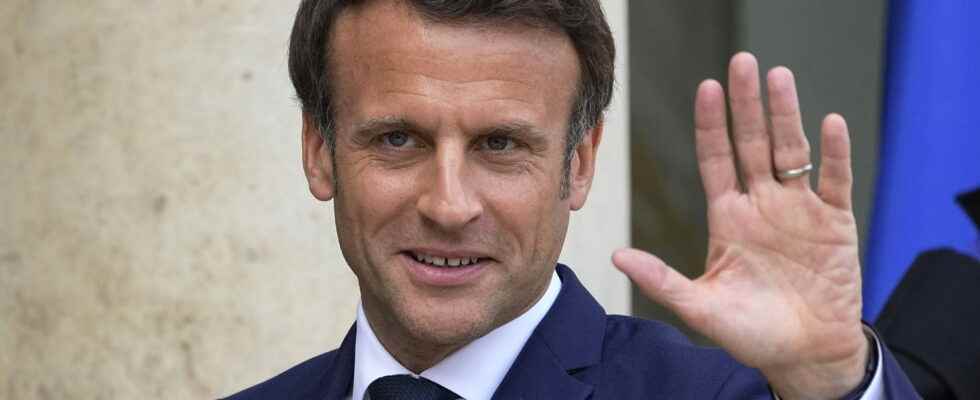

[Mise à jour le 30 mai 2022 à 16h44] The exceptional purchasing power bonus, also called the “Macron bonus” (a time “covid premium“) has been renewed in 2022. It was paid between 1er June 2021 and March 31, 2022 to employees who received a gross salary of less than 3 times the minimum wage during the 12 months preceding the payment of the bonus and is exempt from income tax within certain limits. It is also exempt from contributions for the employer. During the presidential campaign, Emmanuel Macron proposed to triple the amount of this bonus tax-exempt. During the May 11 Council of Ministersthe government confirmed that “private sector employees will benefit from the perennial tripling of the ceiling of the so-called “Macron” purchasing power bonus without taxes or charges”. Who is concerned by this new Covid bonus? What is the amount ? What terms ? Is it taxable?

What is the Macron bonus?

In the midst of the Covid epidemic, the Prime Minister John Castex announced on March 15, 2021 “an exceptional bonus of 1000 euros tax exemption of which “second line” workers should be the privileged beneficiaries”. This announcement was made after the third social dialogue conference with the social partners. This premium actually corresponds to the renewal of the exceptional bonus for purchasing power (PEPA)said “Macron bonus” introduced by the law n°2018-1213 of December 24, 2018, paid in 2019, 2020 and 2021. This grant is intended for increase the purchasing power of employees and is added to their usual remuneration. It cannot replace this remuneration or any other bonus that would be due to the employee(s) of the company. She was reappointed in 2022 by the amending finance law published in Official newspaper July 20, 2021.

What is the amount of the “purchasing power” bonus?

The premium is capped at 1,000 euros in companies that have not signed a profit-sharing agreement and 2,000 euros in companies that have signed a profit-sharing agreement or in companies with less than 50 employees or for workers in the “second line“if measures to upgrade their professions are taken. Second-line workers are all workers outside the medical professions who have been in contact with the public during the health crisis: cashiers, cleaners of urban spaces, maintenance agents, home helpers, construction workers…

► Note : during the presidential campaign, Emmanuel Macron proposed that the ceiling of the bonus be tripled and goes from 1000 to 3000 euros; and from 2,000 to 6,000 euros for companies offering a profit-sharing plan. During the May 11 Council of Ministersthe government confirmed that “private sector employees will benefit from the perennial tripling of the ceiling of the so-called “Macron” purchasing power bonus without taxes or charges”.

Is the Macron bonus taxable?

The Macron bonus is exempt from income tax up to a limit of 1,000 euros or 2,000 euros in companies that have signed a profit-sharing agreement or in companies with fewer than 50 employees or even for second-line workers if an agreement to promote their professions has been concluded. If you received it within these limits, you will not be taxed on it and you do not have to do anything in particular when completing your declaration.

Who can receive the Macron bonus?

The bounty paid from June 2021 to March 2022 has benefited the employees bound to the company by an employment contract, to temporary workers made available to the company or to public officials of a public establishment of an industrial and commercial nature (EPIC) or a public establishment of an administrative nature (EPA) when it employs staff under private law (such as, for example, regional health agencies – ARS) on the date of its payment. The system is also applicable to Esat for premiums paid to disabled workers. Only employees whose remuneration is less than 3 times the amount of the minimum wage over the 12 months preceding its payment receive the Macron bonus. Following the increase in the minimum growth wage (Smic) by 2.2% on 1er October 2021, employees who earn a maximum of €4,768.41, against €4,6631.74 previously, became eligible for the purchasing power bonus.

What are the conditions for receiving the Macron bonus?

The payment of the exceptional bonus for purchasing power or “Macron bonus” is at the discretion of the company. According to the amending finance law of 2021 published in the Official Journal on July 20, the bonus must meet the following conditions to qualify for social and tax exemptions:

- be an employee bound to the company by an employment contract, temporary made available to the company or public official of a public establishment of an industrial and commercial nature (EPIC) or a public establishment of an administrative nature (EPA) when it employs personnel under private law (such as regional health agencies – ARS) on the date of its payment;

- have a remuneration less than 3 times the amount of the Smic over the 12 months preceding its payment;

- the bonus cannot replace an increase in remuneration or a bonus provided for by a salary agreement, the employment contract or a practice in force in the company or public establishment;

- the bonus is capped at 1,000 euros in companies that have not signed a profit-sharing agreement;

- the bonus is capped at 2,000 euros in companies that have signed a profit-sharing agreement or in companies with fewer than 50 employees or even for second-line workers if measures to upgrade their professions are undertaken.

- Disabled workers can benefit from the bonus: if they are linked to a work assistance establishment or service (Esat) by a work support and assistance contract; and whether all disabled workers linked to the Esat are concerned by the payment of the exceptional bonus.

What is the date of payment of the Macron bonus?

The last Macron bonus was paid between 1er June 2021 and March 31, 2022.

Sources:

The exceptional purchasing power bonus is renewed in 2021. July 21, 2021. Service-public.fr

“Prime Macron”: details on the terms of payment of the exceptional purchasing power bonus in 2021. April 28, 2021.

Social dialogue conference, March 15, 2021.

The exceptional bonus of purchasing power. Ministry of Labour. January 7, 2021.