(Finance) – Positive last session of the week for Wall Streetalthough the S&P 500 is still on track to close the week below 4,000 points, for the first time since March 2021, as well as scoring the eighth week of reductions. Although the general context has not changed, investor sentiment has received a small injection of positivity from the activity of the Chinese central bank (the PBOC has in fact cut the Loan prime rate for five-year loans by 15 basis points, beyond expectations).

However, the concerns of market operators remain strong: the May fund manager survey surveyed by Bank of America has certified that optimism about global growth is at an all-time lowbelow levels that characterized the recessions of 2000, 2008 and 2020.

“As investors have realized that ‘The Fed is not your friend,’ it appears to be establishing one bear market mentalityin which there is an increasing tendency to sell any rally, replacing the buy every dip principle – said Mark Dowding, CIO of BlueBay – This change in sentiment continues to be felt especially in the assets with the highest levels of participation of retail investors, although a growing shock is spreading among some institutional investors we meet, in the face of losses accumulated since the beginning of the year “.

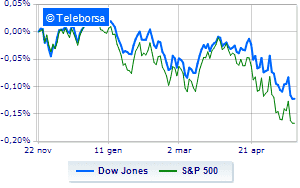

Slightly up for Wall Streetwith the Dow Jones, which advances to 31,428 points (+ 0.64%); on the same line, rising theS & P-500, which increases compared to the day before reaching 3,933 points (+ 0.91%). Positive the Nasdaq 100 (+ 0.96%); with similar direction, in cash theS&P 100 (+ 0.96%). In the S&P 500, the performance of the compartments power (+ 1.88%), telecommunications (+ 1.22%) e informatics (+ 1.17%).

At the top of the ranking of American giants components of the Dow Jones, Nike (+ 2.05%), Salesforce (+ 1.99%), Cisco Systems (+ 1.91%) e Visa (+ 1.85%).

The strongest sales, on the other hand, show up on Boeingwhich continues trading at -1.98%.

Under pressure Caterpillarwith a sharp decline of 1.80%.

On the podium of the Nasdaq titles, Palo Alto Networks (+ 8.25%), Crowdstrike Holdings (+ 6.85%), Zscaler (+ 6.13%) e NetEase (+ 4.06%).

The strongest sales, on the other hand, show up on Ross Storeswhich continues trading at -22.18%.

At a loss Dollar Treewhich falls by 3.22%.

Suffers O’Reilly Automotivewhich shows a loss of 1.09%.

Prey of the sellers Nvidiawith a decrease of 1.06%.

Between the data relevant macroeconomics on US markets:

Tuesday 24/05/2022

15:45 USA: Composite PMI (preceding 55.1 points)

15:45 USA: Manufacturing PMI (preceding 59.7 points)

15:45 USA: PMI services (preceding 54.7 points).