Like a leitmotif, the accusation of greenwashing comes up regularly when we talk about the funds responsible. Moreover, the legislator and the regulator, well aware of this risk, are working hard to regulate sustainable finance, producing a considerable volume of texts. However, certain debates sometimes arise from misunderstanding between investors and managers. Decryption of six of them.

1. “ISR meets a strict definition”

Socially responsible investment (SRI) is “an approach aimed at applying the principles of sustainable development to investment”, indicates the ISR label website. A setting that couldn’t be more vast! The acronym itself is controversial because it results from a (bad) translation from English. “The word “socially” immediately brings to mind the class struggle as it refers to the societal dimension of this form of investment”, underlines Grégoire Cousté, general delegate of the Forum for Responsible Investment (FIR) association. . Since then, English speakers have adopted the term sustainableeither “sustainable” or “sustainable”, easier to understand.

Whatever the word used, it covers a wide variety of approaches and different degrees of sustainability. “ISR is a concept and therefore covers a set of inconsistent supports,” recognizes Hervé Guez, director of equity, interest rate and solidarity management at Mirova. The most widespread strategy consists of scrutinizing company practices (waste treatment, gender equality, training, etc.) to select the best students in each sector. In this scenario, it is possible to invest in oil companies, provided that you favor the most virtuous of them.

Other products will focus on certain sustainable activities, such as renewable energies. “Thematic funds, particularly environmental, speak more to savers, but not all companies that manufacture wind turbines necessarily have their place in an SRI portfolio because some do not adopt a minimum standard of environmental, social and governance practices (ESG)”, points out Coline Pavot, head of responsible investment research at La Financière de l’échiquier.

To account for this diversity, asset managers must respect numerous transparency rules and precisely indicate their method to savers. Despite this, the European Union plans to create categories to better classify the offer and, in particular, distinguish funds investing in environmental and social solutions from those that target companies with good ESG practices, exclusion strategies or still the funds willing to finance the transition.

2. “Investing in SRI funds helps save the planet”

“There is a gap between the marketing of SRI funds and what they finance, regrets Anne-Catherine Husson-Traore, general director of Novethic. Many use images of blank space while the aim of SRI funds is to finance a sustainable and resilient economy, not specifically to preserve nature.”

First of all, you must keep in mind that by acquiring shares in equity funds, you are investing in the capital of listed companies. That is to say that your money will allow other shareholders to recover their capital. Except in the case of IPOs, there is therefore no additional financing provided to companies.

Second, most backgrounds are very bland. “Managers should move more towards products different from the major market indices,” says Anne-Catherine Husson-Traore. However, many vehicles maintain a geographic and sectoral distribution close to that of the CAC 40 or Euro Stoxx 50 in order to maintain results close to those of the markets. “To meet the expectations of savers, on the contrary, we must offer thematic funds, even if these products carry a higher sectoral risk, which leads to volatility, believes Hervé Guez. The client must accept the possibility of a sub-funding. temporary performance.”

To increase their reach, some management companies rely on “shareholder engagement”. This concept brings together all the actions they take to influence business practices. This includes votes at general meetings, as well as all exchanges with management to encourage them to improve the company’s practices. “We already communicate on our actions in our annual report. The next step will consist of indicating our commitment approaches fund by fund in order to provide tangible elements in the reporting”, indicates Matt Christensen, global head of sustainable investment and of impact at Allianz GI. The impact of these policies is, however, complex to measure, especially since “companies encounter difficulties in adapting their business models to ecological and social issues”, estimates Anne-Catherine Husson-Traore.

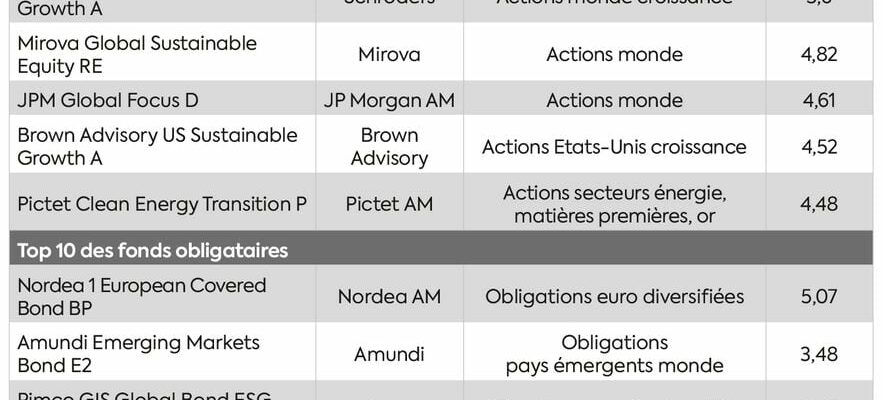

3804CT ISR management

© / The Express

3. “SRI costs more”

Extra-financial analysis means additional resources, both on the human side with specialists trained on these subjects, and on the data side with the use of data providers focused on ESG. A surplus of work which suggests that these products bear higher costs. However, a study published in May 2021 by the AMF reached the opposite conclusion. His conclusion? “Fund shares taking extra-financial criteria into account would tend to be significantly less expensive than their equivalents without an extra-financial approach.”

According to the authors, several factors explain this counterintuitive result, in particular the fact that these supports would constitute loss leaders for management companies. “They are fighting to raise capital for their SRI funds. They therefore cannot afford to pass on the additional cost,” confirms Coline Pavot. Additionally, with the spread of ESG, most funds benefit from this analysis in one way or another. “We have a global active management offering and our resources benefit all of our products,” reports Matt Christensen. “The analysis is created on a centralized system for all of our funds.” Its cost is therefore smoothed across the entire range of media.

4. “ISR is reserved for equity funds”

If ESG analysis was first developed on vehicles invested in stocks, bond and money market funds then took up the subject. In 2021, the Axylia firm highlighted this: money market funds, which invest in very short-term debt securities, accounted for 60% of assets among French law vehicles holding the ISR label. It was only 31% in 2020 and even much less before.

However, “it is in equity funds that ISR is best expressed”, believes Grégoire Cousté of FIR. They are in fact the only ones to invest for the long term and to be able to implement strong shareholder commitment. “We also proposed, during the overhaul of the ISR label, to create different levels of labeling, from the least to the most demanding. Monetary would have found itself at the bottom of the scale,” continues Grégoire Cousté

Bond funds have the same limits as monetary funds but they invest over the longer term. In fact, you are still not the owner of part of the company, only a creditor. “On the other hand, there are sustainable bonds financing green projects or linked to the achievement of specific ESG indicators, which are interesting in terms of impact because they allow financing to be targeted,” comments Coline Pavot.

5. “SRI necessarily excludes fossil fuels”

After months of debate, the Minister of the Economy, Bruno Le Maire, finally decided: no fossil fuels for funds wishing to obtain the SRI label! A requirement which allows a certain consistency between the expectations of savers and the products offered to them. “This is a step forward for the credibility of the label and the financing of a more sustainable economy,” believes Anne-Catherine Husson-Traore. The presence of oil companies in ISR funds was also a source of controversy and incomprehension for savers. .”

However, many players are reluctant to exclude this part of the economy. Thus, TotalEnergies is the fifth company most represented in the portfolios of funds labeled under the old framework. They will have to clean up their act by the end of next year or give up the label.

6. “The ISR label is the only one that exists”

Obtaining the label is based on a voluntary approach on the part of management companies. Generally, the latter only use it for their products marketed to the general public because this seal represents a guarantee of confidence for individuals. They must then respect very precise specifications and submit a complete file to an independent body which will verify compliance with the set criteria. More than 1,200 funds are certified to date.

Please note, however, that the ISR label is Franco-French: establishments operating in several countries can choose other brands, including the Belgian Towards Sustainability, the German FNG-Siegel or even the Luxembourg LuxFLAG ESG.

Certain funds may also favor the Greenfin label, under the Ministry of Ecological Transition and certifying green savings products. Very demanding, it is currently only granted to around a hundred listed and unlisted funds.

Complex European regulations!

Sustainable finance is the armed arm of the European Union to finance the ecological transition. Launched at the end of 2019, the European Green Deal brings together a set of measures aimed at ensuring a new era of growth while achieving climate neutrality by 2050. To finance this project, Brussels has implemented a regulatory arsenal to to direct Europeans’ savings towards green and sustainable activities.

Three main texts structure the sector. Starting with the SFDR (Sustainable Finance Disclosure Regulation), which aims to provide more information to investors to enable them to better compare different sustainable investments. In particular, it introduced a classification of funds according to their degree of consideration of ESG.

The Taxonomy regulation defines the list of green economic activities. It is based on six environmental objectives, including the prevention and reduction of pollution or the mitigation of climate change.

Finally, the overhaul of the MiFID 2 directive (Market in Financial Instruments) requires advisors to question savers about their ESG preferences and to offer them suitable products.

An article from the special report “Responsible Investments”, published in L’Express on May 30.

.