(Finance) – It’s going back a lot 3Mwhich exhibits a negative percentage change of 6.54% after lifting the veil on the quarterly report and announcing a cut in the workforce.

“The slower-than-expected growth was due to the rapid decline in consumer-facing markets – a dynamic that accelerated in December – together with the significant slowdown in China due to the Covid-related disruptions – commented the CEOMike Roman -. As demand weakened, we adjusted production and controlled costs, which allowed us to improve inventory levels.”

“We expect macroeconomic challenges to persist in 2023 – continued Roman -. Our goal is to execute the actions we initiated in 2022 and deliver the best performance to clients and shareholders. Based on what we see in our end markets, we will be cutting about 2,500 workersa necessary decision to align ourselves with the adequate production volumes”

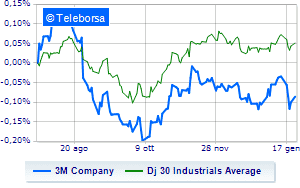

The trend of industrial giant in the week, compared to Dow Jonesnotes a lower relative strength of the stock, which could fall prey to sellers ready to take advantage of potential weaknesses.

Technically, the medium-term situation is negative, while bullish signals can be glimpsed in the short term, thanks to the stability of the support area identified at USD 104.1. The short-term positive cue is indicative of a change in the trend towards a bullish scenario, with the curve that could push towards the important resistance area estimated at 123.5. At an operational level, the most appropriate scenario could be a bullish recovery of the stock, with a resistance area identified at 143.